Why Australians Seek Advice

August 7th 2020 | Categories: Value of advice |

In this article, we look at research commissioned by ASIC and what questions people are asking financial planners to take control of their financial security.

A report commissioned by the Australian Securities and Investments Commission (ASIC) reveals that while 27% of Australians have sought advice, 45% are looking for help when it comes to investments[1]. We all want our money to work harder, and in the report titled ‘Financial Advice: What consumers really think’, we see that 79% of Australians consider ‘expertise’ as the main reason for seeking out an adviser.

Most people have a desire to improve their financial health, but many don’t know how to go about it. Working with a financial planner is a great way to start.

Keep in mind that the numbers from this report are pre-global pandemic and a lot has changed since then. While these numbers do reflect the past environment, they may not be accurate now.

In the current environment, the type of advice our clients seek has slightly changed. However, there are general trends around these questions. More info on this below.

In this article:

- Profile of Australian’s seeking advice

- Why Australian’s are seeking advice

- Questions Australian’s are asking financial planners

- Barriers to seeking advice

Are you looking towards the future however aren’t sure how to finance it? Talk to us today about how to structure a financial plan that starts with your dreams and goals.

[ninja_form id=37]

1. Profile of Australians Seeking Advice

We know from the report released in August 2019 that while 27% of Australians have sought advice, a much larger percentage (41%) state that they intend to seek advice in the future.

Who are the people who have sought advice compared with who has advice on their radar? Let’s take a look.

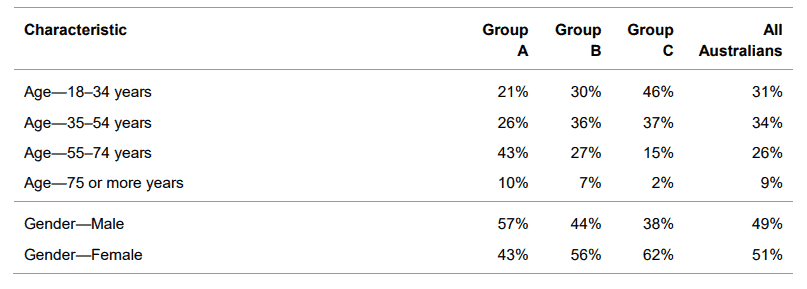

The research classified respondents into three groups as follows:

- Group A – Recently received financial advice

- Group B – Intended to get financial advice in the near future

- Group C – Recently thought about getting financial advice but had not gone ahead.

The survey of 2,545 participants was weighted to the Australian population using the Australian Bureau of Statistics data.

Table 1: Profile of those who have sought and who have considered seeking financial advice.

Source: ASIC Financial Advice: What consumers really think, P.44 & 451. Group A denotes those who had recently received financial advice. Group B intended to get advice in the near future. Group C thought about getting advice however did not go ahead.

We see from the above that those who have sought advice (Group A) are more likely to be 55+, live in a metropolitan area, are paying off or own their own home, earn a high income and are university educated.

In contrast, those seeking advice in the near future are more likely to be 35-54 years old and are less likely to be retired. This group is less likely to have paid off or owned their own home, be university educated, and the data shows a higher percentage of females.

Table 1 indicates that nearing retirement or retirement is the most likely time for advice to be actually sought (Group A), however, those who are mid-career are the ones who have advice on their radar and intend to act upon it. It is typically this group who are looking to consolidate debt and focus on their future.

2. Why Australians are seeking advice

We know from the research that there is a significant number of Australians who seek advice. We also know that 41% are intending to seek advice.

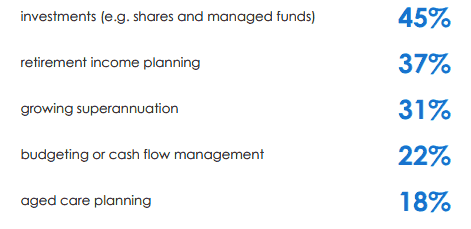

What are the main reasons advice is sought out? What is it clients are looking for? It is clear that wealth creation, financial security, and quality of life is high on the list.

Figure 1: The Topics Australians Want Advice On:

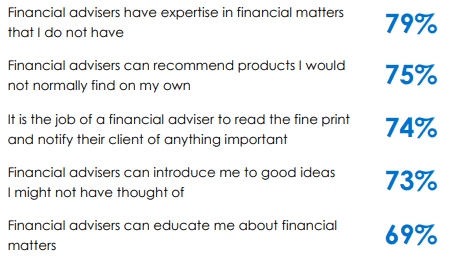

An extension of seeking advice is sourcing a financial adviser. Expertise in financial matters is considered the most important reason why Australians seek advice, followed by product knowledge.

Australians’ attitudes towards financial advisers are certainly positive in the sense that they can provide help in several areas.

Figure 2: Reasons People Use Financial Advisers

Another insight from the report was Australians rated an Adviser’s ‘ability to talk to customers in a way they can understand’ (36%) almost as high as ‘level of experience’ (41%) when looking at what’s important when selecting an Adviser. Australians want to be sure that they can feel well understood when seeking advice and understand the conversations had.

At Invest Blue we have a series of meetings that have been designed to be about you and your goals and dreams for the future. In the first meeting, which is complimentary, we take time to learn about your situation and what you are wanting to achieve.

“A great first meeting is when an open and honest conversation occurs, where we all have a good grasp of the common goals. We want our clients to have value, and there are usually things people could be doing better straight away. By the time the second meeting is held, people have often already seen some improvement to their financial situation.”

~ Invest Blue Financial Adviser

3. Questions Australian’s are asking financial planners

We know from the report debrief above that Australian’s are seeking financial advice predominantly because of the planner’s expertise and ability to communicate in a way that is clear and understandable.

Also from above, we know that the topics Aussies generally want advice on are investments, retirement income planning, growing superannuation, budgeting and cash flow management, and aged care planning.

However, in the current environment, the type of advice our clients seek has slightly changed. There are still general trends and a strong need for advice on the topics above, but we have noticed a certain few questions are coming in loud and clear.

Investment & Superannuation uncertainty

Due to continued uncertainty surrounding the pandemic, economies all over the world have been affected. With this comes volatility within markets and inevitably share prices and superannuation likely fall, which we have seen to date. This has left our clients asking questions like ‘What should I do about my superannuation balance falling?’, and ‘Do I need to make changes to my investment portfolio during COVID?’.

Advice around these kinds of questions is very specific to each individual. For advice that applies to you and your situation, we recommend working directly with a financial planner.

For some more info on these topics check out the below articles.

- When to pull out of an investment

- My superannuation balance is falling, what should I do?

- Is now a good time to invest in shares?

- Is now a good time to invest in the property market?

It is also interesting to note that while many people are seeking advice around wealth protection, some are also leveraging this unique period to increase their investment portfolio.

Home loan support

The Coronavirus has caused many people to experience a reduction or in some cases, total loss of income. If you’re renting a property or paying off a mortgage, you may be struggling to meet payments.

We’re often asked questions like ‘How can I reduce my home loan during COVID-19?’ and ‘As a renter, what support do I have during COVID-19?’.

Landlords are also finding themselves between a rock and a hard place, trying to do their best for tenants but also trying to meet their own financial liabilities. We’re often asked ‘As a landlord, how can I manage the impacts of COVID-19?’.

Divorcing during COVID-19

Separation and divorce have proven other stand out topics for advice in recent times. In response to the reoccurring questions, we wrote an article on preparing your finances for divorce in the current environment.

4. Barriers to seeking advice

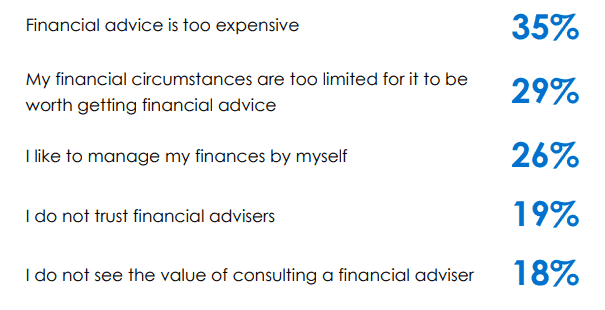

The final area we explore in this article is the barriers to seeking advice. We know that there is strong intent from Australians to seek advice, however, what is it that is stopping them?

ASIC reports that cost comes up as the first reason, as there is a perception that financial advice is too expensive. People also feel that their situation is not sophisticated enough to justify advice.

Some are savvy and feel they have the tools, whereas others have a distrust of advisers, partly fueled by the Royal Commission.

Invest Blue has worked with thousands of clients, to provide advice for their specific and unique set of circumstances. We find that relief is often the feeling that clients feel once they have had their first meeting and broken the ice with their adviser.

We regularly publish Client Stories that demonstrate the value of advice from the perspective of different Clients who have faced their own set of challenges. You can read some of our Client Stories here.

Figure 3: Barriers to Seeking Advice

Other insights from the report included that those who had sought advice more recently had a more positive attitude towards financial advisers. It seems that a level of comfort is established with regular contact. We do this 12-monthly at Invest Blue once a plan is in place, via our Progress Meeting. You can also read more about strategies for implementing your financial plan here.

The report also showed that financial advisers are considered to introduce clients to ideas that they might not have thought of on their own. Many of our Advisers have achieved Most Trusted Adviser Status through the independent body of the Beddoes Institute. You can check out our Adviser credentials here.

The uptake of digital, or ‘robo’ advice was another interesting finding, with 19% of respondents being open to using this type of advice whilst only 1% had tried it[2]. Those who were looking to take up advice were more likely to consider digital advice.

Are you ready to join those who have sought advice to maximise their financial situation and focus on their dreams and goals for the future? It’s never too early or too late to live your best possible life, no matter what your situation is. Contact us or ask us a question. We’re here to help at Invest Blue!

[ninja_form id=41]

[1] https://download.asic.gov.au/media/5243978/rep627-published-26-august-2019.pdf

[2] https://www.professionalplanner.com.au/2019/08/clients-want-product-and-investment-advice-new-research/

What you need to know

This information is provided by Invest Blue Pty Ltd (ABN 91 100 874 744). The information contained in this article is of general nature only and does not take into account the objectives, financial situation or needs of any particular person. Therefore, before making any decision, you should consider the appropriateness of the advice with regards to those matters and seek personal financial, tax and/or legal advice prior to acting on this information. Read our Financial Services Guide for information about our services, including the fees and other benefits that AMP companies and their representatives may receive in relations to products and services provided to you.

Posted in Value of advice