What the 2021/22 budget means for you

May 12th 2021 | Categories: Federal Budget |

The Federal Budget for 2021-22, declared the ‘recovery budget’, has now been released. The key focus is on economic recovery and getting Australians back to work. The deficit is expected to peak at $161bn this financial year (down from $214bn in October’s Budget) and fall to $107bn in 2021-22.

Overall, we see this year’s budget release as a positive step forward with additional benefits we believe our clients can leverage, particularly in the superannuation, aged care and tax sector. Below we cover the areas that you may benefit from, from a financial planning perspective and discuss how you can incorporate these changes into your financial plan and goals from 1 July.

You can read our economic update here.

Superannuation & SMSF Changes

There are now opportunities to increase your superannuation contributions through changes to the work test age, as well changes to downsizer contributions and exit from legacy products.

When navigating these changes, it’s critical to consider your broader financial goals. Your Adviser will be able to help you understand how these may be of benefit to you and accommodate them into your financial plan.

Changes to work test age

From 1 July, those aged 67 to 74 years can now make or receive non-concessional super contributions or salary sacrifice contributions without meeting the work test criteria (min 40 hours of work over 30 days). Contributions are still subject to existing contribution caps. These individuals will also be able to access the non-concessional bring forward arrangement, subject to meeting the relevant eligibility criteria. The work test (or recent retiree work test exemption) will still have to be met by individuals aged 67 to 74 years wanting to make personal deductible contributions.

The removal of the work test will enable more people to save into their super and have more room for movement with their retirement planning and funding.

You can read more about super and retirement here.

Extending downsizer contributions

Currently, downsizer contributions to super can only be made by individuals aged 65 or older. The government is now lowering this age from 65 to age 60. This means retirees who sell their long-term home can contribute $300,000 to their super, fund their retirement, and create liquid assets. All other eligibility criteria for downsizer contributions remain unchanged.

Downsizer contributions do not count toward an individual’s non-concessional contribution (NCC) cap. Some options may enable individuals under 65 to make super contributions up to $630,000 if eligible by combining the NCC cap and a downsizer contribution.

Flexibility around legacy products

There is a two-year window for those on retirement legacy products, such as market-linked, life-expectancy and lifetime products, to move all funds into their superannuation and exit their current product. Many of these older products are outdated and expensive, but there could be social security and tax implications for making this change. We recommend you discuss this with your Adviser to find out what this would mean for you.

No super contribution minimum

Employees of all income levels will now receive super guarantee contributions as the current $450 per month minimum income threshold will be removed from 1 July.

On 1 July, SG contributions will change from 9.5% to 10% and are set to increase to 12% by 2022.

Read more about super contributions here.

Aged Care

There is good news for our older Australians. In response to the recent Royal Commission into Aged Care Quality and Safety, the government will deliver a much needed $17.7 billion boost for a comprehensive aged care reform package. Funding will be allocated over five years with a focus on home care, as well as the sustainability, quality and safety of residential care.

The impacts of this proposal will be immediate (and ongoing), including the release of 80,000 new home care packages over two years (2021-22) and a commitment by the government to improve daily living conditions in residential care by contributing $10 per day for each resident on top of the basic daily fee.

Moreover, the government is aiming to raise the standard of residential aged care by requiring residential care facilities to deliver an average of 200 care minutes for each resident every day from 1 October 2023.

Read more about our aged care support here.

Pension Loan Scheme

The Pension Loan Scheme (PLS) enables senior Australians to voluntarily receive fortnightly loan payments from Centrelink to supplement their retirement income. To be eligible for the scheme, you must own real estate in Australia, and the combined Age Pension payment and loan amount should not exceed 150% of the maximum pension payment.

To increase the flexibility and attractiveness of the PLS, the government is increasing a ‘No Negative Equity Guarantee’ for PLS loans to ensure that borrowers (or their estate) will never owe more than the value of their equity in the property the loan is secured against; and providing the option to access up to two lump-sum loan advances in any 12-month period. The total of these can be up to 50% of the maximum annual rate of the Age Pension.

Tax Benefits

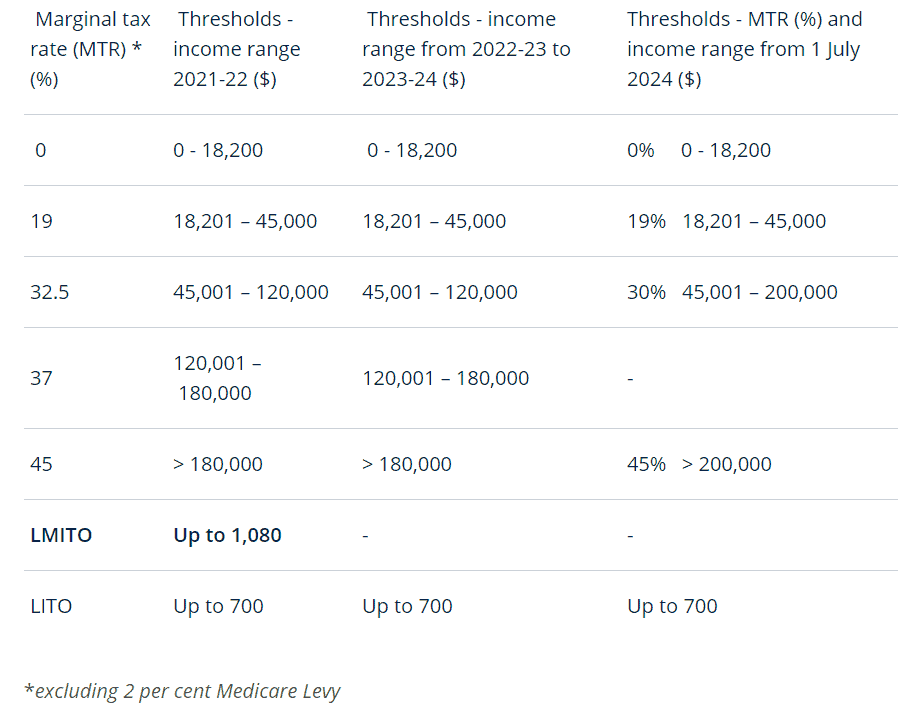

Low- and Middle-Income Tax Offset to Remain

(LMITO), which was due to end on 30 June 2021 will now be retained for one more year in 2021-22.

Medicare Levy Increase

The Medicare levy low-income thresholds for singles, families, and seniors and pensioners will increase effective 1 July 2021 so that low-income taxpayers generally continue to be exempt from paying the Medicare levy.

The threshold for:

- singles will be increased from $22,801 to $23,226,

- families will be increased from $38,474 to $39,167,

- single seniors and pensioners will be increased from $36,056 to $36,705, and

- families (seniors and pensioners) will be increased from $50,191 to $51,094.

For each dependent child or student, the family income thresholds increase by a further $3,597

Self-Education Expenses

Under the current rules, taxpayers cannot claim a tax deduction for the first $250 of expenses for prescribed courses of education. This threshold is proposed to be removed from 1 July.

Small Business Tax

Temporary Full Expensing Extended

The ‘temporary full expensing of capital assets’ measure will be extended for 12 months until 30 June 2023 to allow eligible businesses with aggregated annual turnover or the total income of less than $5 billion to deduct the full cost of eligible depreciable assets of any value, acquired from 7:30 pm on 6 October 2020 and first used or installed ready for use by 30 June 2023. All other elements of temporary full expensing will remain unchanged, including the alternative eligibility test based on total income, which will continue to be available to businesses. From 1 July 2023, normal depreciation arrangements will apply.

Loss Carry Back Extended

Temporary loss carry-back is to be extended to allow eligible companies to carry back (utilise) tax losses from the 2022-23 income year to offset previously taxed profits as far back as the 2018-19 income year when they lodge their 2022-23 tax return. Loss carry-back provides eligible companies earlier access to the tax value of losses generated by full expensing deductions. Companies with aggregated turnover of less than $5 billion are eligible for temporary loss carry-back.

Housing Affordability

On top of the already low-interest rates, the government is continuing programs to help improve the affordability of buying a home. Now is a great time to refinance or make the most of some of the key budget incentives mentioned below.

Chat to our experienced lending team to find out if we can help you save on your mortgage and take advantage of the latest government benefits listed below.

First Home Super Saver Scheme (FHSSS) Cap Increased

The government has announced that the cap on withdrawals of voluntary contributions from the FHSSS will be increased to a maximum of $50,000 plus notional earnings per eligible person. Withdrawals are currently capped at a maximum of $30,000 plus notional earnings per person.

First Home Loan Deposit Scheme (FHLDS) Extended

The government has announced that an additional 10,000 places will be made available in the FHLDS (New Homes). The new places will be available in the 2021-22 year. The extension of the FHLDS will apply to first home buyers who buy a newly constructed home or who build a new home.

The FHLDS allows first home buyers/builders to borrow more than the standard 80% of the property’s value with only a 5% deposit, with the balance (15%) being underwritten by a government agency in the event of a loan default and shortfall. The FHLDS allows eligible first home buyers to borrow more without paying the premium for Lender’s Mortgage Insurance which would otherwise apply in such situations.

HomeBuilder program

The government will extend the construction commencement requirement under this existing program from the existing 6 to 18 months.

Family Home Guarantee scheme

The government will establish a program similar to the FHLDS above to allow eligible single parents with dependants to enter or re-enter the housing market with a deposit as little as 2%. The scheme will have 10,000 places and be available from 2021-22.

Women and Childcare Incentives

As much anticipated, this years’ Budget places a real emphasis on the safety, economic security and health and wellbeing of Australian women. Moreover, the Government has indicated that it will not proceed with the proposal to the extent of early release of superannuation to victims of family and domestic violence.

The 2021-22 budget aims to address violence against women and children, reduce workplace sexual harassment, improve the accessibility and quality of women’s health services and strengthen women’s economic security by making childcare more affordable and supporting employment and financial security.

You may be interested in reading our article closing the gap between women and finance.

What does this mean for you and your goals?

For many of our clients, their big dreams to travel abroad have sadly been postponed to an excepted minimum of 2022 but that doesn’t mean it’s time to stop dreaming.

We encourage all our clients to review their goals during this period and possibly take advantage of some of the benefits mentioned above or consider investing your travel funds or travel within our beautiful Australian bubble.

Many honeymooners are now heading south to Tasmania, others are setting sights on the heart of Australia and exploring Uluru. The New Zealand bubble is now also open, presenting a great opportunity for Australians to safely travel overseas. Here’s a cheeky ad meant to inspire the Kiwi’s head our way, it might get you inspired Tourism Australia – Be the First!

Chat to your Adviser or book an appointment with an Adviser to find out how you can leverage these latest benefits or to review your dreams and goals.

[ninja_form id=41]

What you need to know

This information is provided by Invest Blue Pty Ltd (ABN 91 100 874 744). The information contained in this article is of general nature only and does not take into account the objectives, financial situation or needs of any particular person. Therefore, before making any decision, you should consider the appropriateness of the advice with regards to those matters and seek personal financial, tax and/or legal advice prior to acting on this information. Read our Financial Services Guide for information about our services, including the fees and other benefits that AMP companies and their representatives may receive in relations to products and services provided to you.

Sources:

Posted in Federal Budget