Understanding your loan

May 16th 2024 | Categories: Home Loans & Leveraging Equity |

The difference between good debt and bad debt all comes down to loan literacy, here’s your starting point for making informed decisions about borrowing money and managing your finances effectively.

The need-to-know terms

Variable interest rates can change over time based on fluctuations in the market or economic conditions. Your interest rate and monthly payments may vary, depending on changes in the benchmark rate set by the lending institution or external factors such as the Reserve Bank of Australia’s cash rate.

Fixed interest rates remain constant for a specified period, typically ranging from one to five years or even longer. During this period, your repayments remain unchanged regardless of any fluctuations in the market interest rates. Fixed-rate loans offer stability and predictability, making it easier for borrowers to budget their finances.

A cash rate is interest rate set by the Reserve Bank of Australia (RBA). It influences the interest rates that banks and financial institutions offer to borrowers. Changes in the cash rate can have a significant impact on borrowing costs. This applies to both variable and fixed-rate loans.

The credit approval process is when a lender checks a borrower’s credit and decides if they can borrow money. Lenders will assess your current income, employment, assets and how reliably you have repaid any credit cards or past personal loan payments. Once approved, the borrower will receive confirmation of the loan terms and conditions.

Fees and charges are the additional costs associated with obtaining and maintaining a loan. These may include application fees, establishment fees, ongoing account-keeping fees, annual fees, early repayment fees, and late payment fees. Carefully review and understand all the charges associated with a loan to assess its affordability and suitability to your overall financial situation.

Interest rates in action

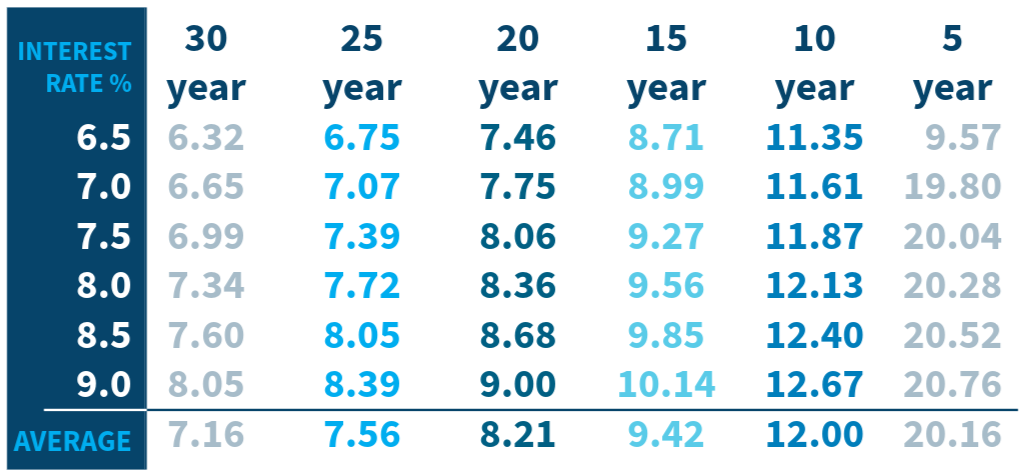

NOTE: The table above indicates the factors for loans with interest rates from 6.5% to 9% over 5 years to 30-year terms.

For example, the amount borrowed is $100,000 at a 7% interest rate and monthly repayments of $899. The borrower will fully repay the loan amount and interest over a 15-year term at a higher interest rate of 8.99%.

The above factors illustrate how compound interest works. Relatively small increases in repayments will reduce the loan from 30 years to 20 years, but it will take a large increase in repayments or lump sum to decrease the loan from 10 to 5 years.

As the term of the loan lengthens, the effect of the interest rate results in the amount of interest you pay, which increases the cost of the loan exponentially. Making repayments at $20 per $1,000 borrowed will pay the loan off in 5 years, where interest rates have little effect.

Paying less than $8 per month increases the loan term to over 20 years. Now interest rates are starting to play a major factor in the amount of interest that must be repaid.

Considering your financial situation and budget consciously when committing to your monthly repayments is important. But if you can afford it, paying back more each month will not only reduce the term of your loan but also save you money in the long run.

Our team of lending experts can help you at any stage in your home ownership journey, get in touch here.

Need to reassess your interest rate? Compare current interest rates from over 60 lenders, here.

If you would like to discuss or reassess your loan options, our lending team can help!

Want a Complimentary Consultation?

Fill in the form for a complimentary consultation with a Financial Adviser and start living your best possible life.

What you need to know: This information is provided by Invest Blue Pty Ltd (ABN 91 100 874 744). The information contained in this article is of general nature only and does not take into account the objectives, financial situation or needs of any particular person. Therefore, before making any decision, you should consider the appropriateness of the advice with regards to those matters and seek personal financial, tax and/or legal advice prior to acting on this information. Read our Financial Services Guide for information about our services, including the fees and other benefits that AMP companies and their representatives may receive in relation to products and services provided to you.

Posted in Home Loans & Leveraging Equity