Super funds – how do I pick the right one?

March 26th 2019 | Categories: Superannuation & SMSF |

Balanced, growth and performance

If you are taking the time to consider which superfund is best for you, it is more than likely you will try to compare the short, mid and long-term performance of your current fund against others to see how they have gone. You will probably assume that if you compare the same ‘investment option’ from one fund to another that you would be comparing like for like. How else are you to know which fund is doing better? Unfortunately, this approach isn’t going to tell you near enough to make an informed decision. There are no standard guidelines for how a superfund labels their investment approaches. What one fund labels as ‘balanced’ another might consider a more aggressive ‘growth’ approach.

Understand how your decisions and actions today may affect your financial security tomorrow. Get in touch.

[ninja_form id=37]

Why does it matter?

It matters a lot to you as a person because the underlying risk that is inherent with each portfolio mix varies widely. In other words, the pool of investments one fund picks for you could be considered more ‘risky’ by another fund. You need to be aware of and comfortable with that level of risk.

Portfolios that are heavy on the ‘growth’ asset classes tend to do well when markets are strong, they can even do really well! When markets are weak or negative, they are more likely to do underperform. Higher levels of risk mean higher degrees of volatility – or variability in return.

If you are young and have a long investment timeframe, higher growth potential over the long term will likely outweigh concerns over short term volatility. But that may not be your style. Super is not an abstract investment thing that happens behind the scenes. Nearly 10% of your pay is invested regularly, how it is invested should be really important to you.

The term ‘balanced’

“From my experience, most clients come in with the perception that a ‘balanced’ investment fund or super fund portfolio would be 50% in growth and 50% in defensive asset classes,” reports Financial Adviser, Chris Ogilvie. That intuitively makes sense. After all, to balance you need to have equal weighting on both sides. But in the financial world, the term is used loosely and in varying ways.

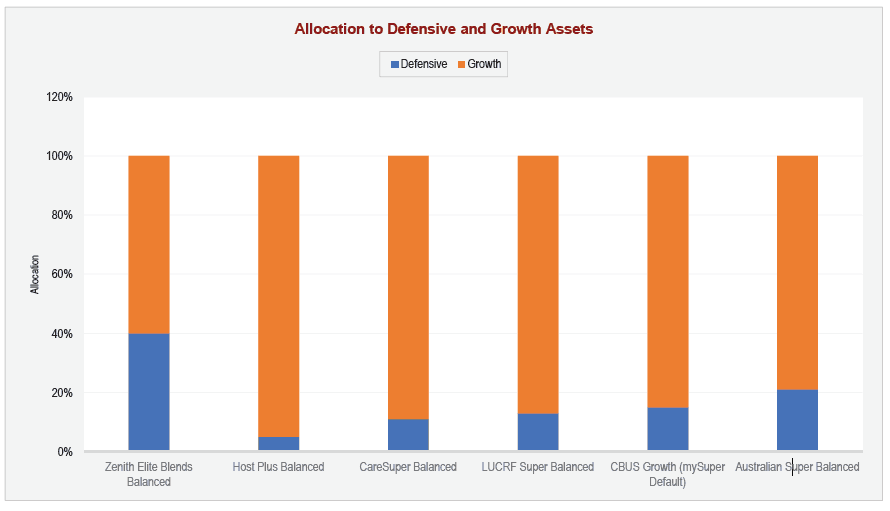

Zenith Investment Partners recently released a study examining the allocation to defensive and growth assets inherent in their own ‘balanced’ fund vs. the ‘balanced’ fund of 5 Industry Super Funds. According to their report, “Zenith advocates for a 60%/40% split, in terms of growth and defensive assets. At a very basic level, growth assets are riskier investments, such as equities, property and certain alternatives. Defensive assets typically include traditional fixed interest and cash.”

How much do funds vary?

In their research, Zenith found that the variation in ‘balanced’ funds is quite wide. The common range is 60-80% in growth assets however it can be even higher. “In good years, it is easy for a fund that has 90-95% invested in growth assets to look like it has performed exceptionally well when in reality they have taken extra risk to get that return. It really isn’t lining up the risk and reward model for consumers.” Says Chris Ogilvie.

An example of the asset allocation variability of balanced funds is shown in the graphic below. With Growth assets of “balanced funds” ranging from as low as 60% through to as high as 95%, it makes it challenging for investors to compare the absolute performance of balanced funds across the marketplace. Investors need to keep this in mind when comparing the performance league tables. It makes it hard to compare when you are comparing not only pears but apples, oranges a host of other fruit.

So what should you do about it?

“You have to understand the fund; you can’t rely on the label. You have to have a good look under the hood to understand the investment strategy of the Superfund, and how it aligns with your preferences, tolerance for risk and goals and objectives,” advises Chris. In our advice process, we take people through a conversation and journey to help them understand their own views on risk and then we marry that up with where they are today and where they want to be in the future before we make a recommendation about investment strategy. “It is really helpful for our clients to be able to work this out with someone who knows and understands the complexities behind the scenes. Consumers assume that funds will have their best interests in mind when they label and market an investment choice, but it really is a personal decision, and one best made with the right information and insight at hand. When it comes to a financial planning relationship, there is a far bigger conversation held around risk and return. For some clients, it is the first time they have had to think about it.”

As stated above, your super fund is not just a forced savings plan for your retirement. It is nearly 10% of what you earn each fortnight and it is being invested to help you live the retirement you want when the time comes. Don’t let the ‘balanced’ terminology knock you off your own investment game. If you would like to discuss this more with an expert, come in and have a chat.

Don’t hesitate to seek advice – reach out to us for a chat. Our first meeting is a chance for us all to get to know each other and discuss your needs so we can see if we can help.

[ninja_form id=41]

What you need to know

This information is provided by Invest Blue Pty Ltd (ABN 91 100 874 744). The information contained in this article is of general nature only and does not take into account the objectives, financial situation or needs of any particular person. Therefore, before making any decision, you should consider the appropriateness of the advice with regards to those matters and seek personal financial, tax and/or legal advice prior to acting on this information. Read our Financial Services Guide for information about our services, including the fees and other benefits that AMP companies and their representatives may receive in relations to products and services provided to you. https://www.apa.org/pubs/highlights/peeps/issue-105.aspx https://www.behavioraleconomics.com/resources/introduction-behavioral-economics/

Posted in Superannuation & SMSF