Retirement hotspots – where to invest your money

January 23rd 2020 | Categories: Investing | Retirement |

Perhaps you’ve decided on a sea change or looking for a more relaxed lifestyle by the coast. You’ve worked hard for this moment so it’s in your best interest to be in the place that makes you happiest. Was there a town that always felt like your very own piece of heaven? The kids have all moved out and it’s likely your looking to downsize from the family home, or maybe just a little bit!

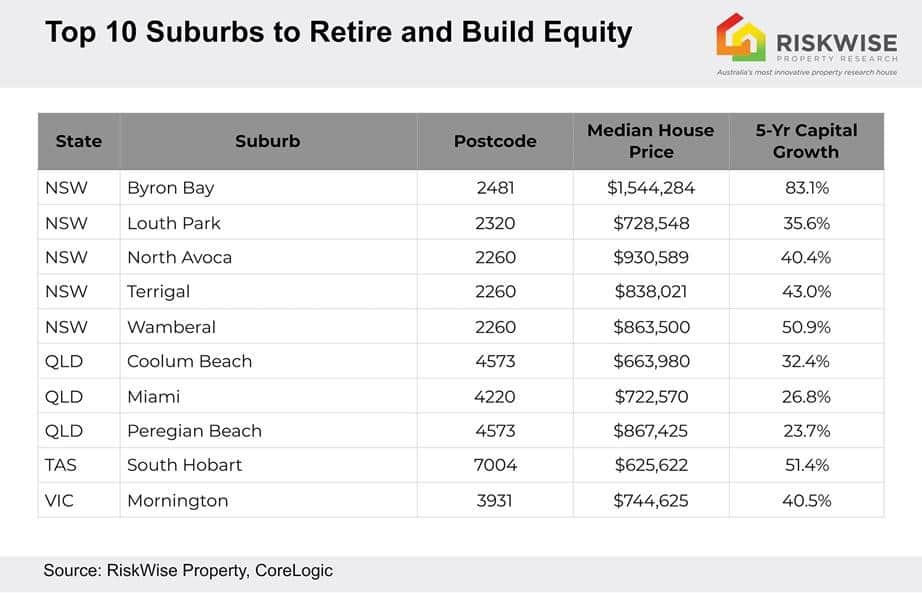

Riskwise Property Research has released the best suburbs for retirees to move to, indicating not only lifestyle choices but also house prices[1]. It is not just about what you need in the immediate future for your retirement – it is also about whether you have the right set up for 5, 10, 20 years’ time.

Riskwise CEO Doron Peleg states that there are three crucial factors retirees should consider – Lifestyle, relative affordability and building equity.

So drumroll, here is the list for your perusal!

Figure 1: Top 10 Suburbs to Retire and Build Equity – Riskwise Property Research

According to RiskWise these areas have shown resilience in the recent downturn and have already experienced good recovery.

Are you looking towards the future however are not sure how to finance it? Talk to us today about how to structure a financial plan that starts with your dreams and goals.

[ninja_form id=37]

Factors to consider

Research is important when choosing where to retire, and what your specific needs are. Nobody likes the thought of packing up and moving several times. Make a list of what is important to you and then rank your top places. You could also do a list of pros and cons.

There are also factors to consider down the track when you retire and then enter into your later years. Some of these are:

- The desire for in-home care vs a retirement village or nursing home – read our article on this topic here.

- Fees for a Retirement Village or Nursing home and how they are calculated – read our article on this topic here and also check out Government calculators for both Home Care Packages and Aged Care Homes.

- Changes to your financial situation as you draw on your super and are deemed eligible for the Age Pension.

- Medical expenses and mobility. You can read our article on how your expenses change in retirement here.

- Proximity to family. Paint Your Retirement Picture here for how you want to live and who you want to spend time with.

City, Country or Coastal?

OK back to the fun stuff! If it is city life you’re after, Australian Seniors reports that the three most affordable cities are Adelaide, Brisbane and Canberra[2]. Outside of the capitals, try Newcastle, Coffs Harbour or Townsville. If this doesn’t whet your appetite enough go laid-back coastal with Tweed Heads, Port Macquarie or Esperance. We are considered to live in the lucky country, after all, so don’t hold back!

For a slice of country life, Australian Seniors suggests Adelaide Hills, Albury or Echuca. These suggestions are more lifestyle based than about building equity, however, the choice is for you to ultimately make.

According to oversixty.com.au for many over-60s your decision will come down mainly to where your children and grandchildren live, what amenities are available, good transport connections and affordable housing[3]. Sunshine can be a good thing too.

They suggest that the most popular places are the Sunshine Coast, with prices ranging from $500 to $2 million, Coolangatta, Tweed Heads, Hunter Valley, Merimbula, Echuca and the Mornington Peninsula among others.

Our top picks by state:

NSW:

Tweed Heads

Byron Bay

Hunter Valley

Newcastle

Central Coast

Port Macquarie

QLD:

Sunshine Coast

Gold Coast

Coolangatta

Townsville

SA:

Adelaide Hills

Kadina

Yankalilla

Adelaide

WA:

Esperance

Geraldton

VIC:

Mornington Peninsula

Echuca

Tas:

Huon Valley

Hobart

When it comes to choosing where to retire, it’s good to give the decision some careful thought. However, it can be a difficult decision because we are spoilt for choice in Australia.

Wherever it is you decide, it is important to make sure your finances are in order, so you can plan your retirement, make a good mental transition and spend more time doing the things you love sooner!

We also have many client stories about life in retirement. You can check them out here.

We have helped hundreds of clients plan their retirement years and have seen many different scenarios. We have a Team of Advisers ready to learn about your goals and hopes for the future and set you on the path to living your best possible life in retirement. Reach out to us today or Book an Appointment.

[ninja_form id=41]

[1] https://www.homestolove.com.au/10-best-suburbs-to-retire-and-build-equity-20884

[2] https://www.seniors.com.au/travel-insurance/discover/best-places-to-retire-in-australia

[3] https://www.oversixty.com.au/finance/retirement-income/11-best-places-to-retire-in-australia

What you need to know

This information is provided by Invest Blue Pty Ltd (ABN 91 100 874 744). The information contained in this article is of general nature only and does not take into account the objectives, financial situation or needs of any particular person. Therefore, before making any decision, you should consider the appropriateness of the advice with regards to those matters and seek personal financial, tax and/or legal advice prior to acting on this information. Read our Financial Services Guide for information about our services, including the fees and other benefits that AMP companies and their representatives may receive in relations to products and services provided to you.

Posted in Investing, Retirement