Mortgage vs Super – Where should I direct my surplus cashflow?

May 16th 2024 | Categories: Budgeting & Goals |

Many of us grapple with a common dilemma: should we channel extra funds towards our mortgage or our super? Deciding between debt reduction and future investment can be challenging. In the mortgage versus super debate, there’s no one-size-fits-all solution. Various factors will come into play when determining the best course of action for you, and it isn’t as simple as comparing average interest rates vs average return on investment.

Super Contributions: Building a Nest Egg for the Future

As an investment, superannuation is one of the most effective vehicles. Whether you are setting up a salary sacrifice arrangement, or making a personal contribution and claiming it later, there are many immediate and long-term advantages to maximising your super contributions.

- Tax Advantages: Contributing to your super can provide direct tax benefits. Concessional contributions are taxed at just 15%, compared to a potential 47% at your marginal rate. Any investment returns within the fund are also only taxed at 15%, and once you enter pension phase, the fund becomes tax free.

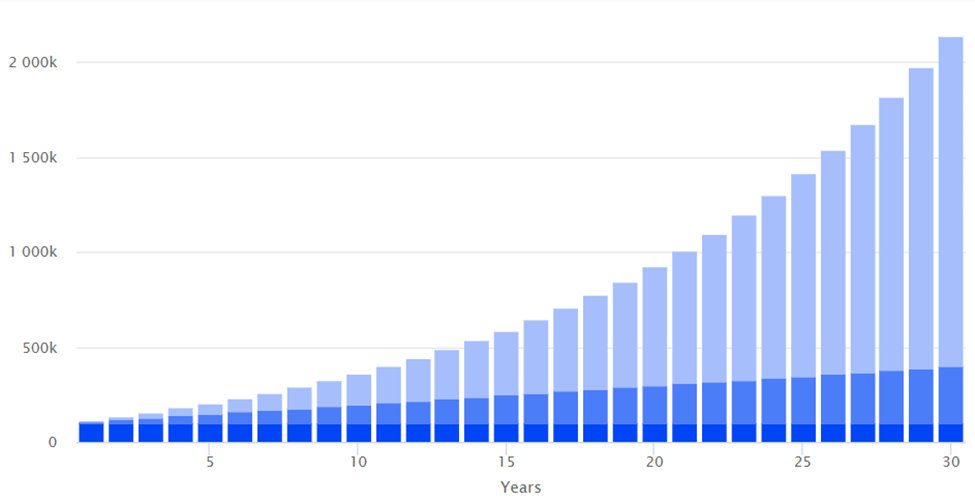

- Compound Growth: Super contributions have the advantage of time on their side. This long investment term, coupled with the lower tax rate means your money can snowball, and generate further investment returns upon returns. This is known as compound returns, or compounding. The power of compounding means that even small contributions over many years could make the world of difference to your super balance come retirement.

- Retirement Security: Increasing your super contributions can enhance your retirement lifestyle, providing a financial cushion to support your desired standard of living once you stop working. Your Super Guaranteed Contributions alone may not be enough to fund your ideal retirement, so boosting your super early can give you some peace of mind.

Compound interest calculator – Moneysmart.gov.au

Mortgage Repayment: Achieving Home Ownership and Financial Freedom Sooner

Paying off your mortgage ahead of schedule can bring a sense of security and financial freedom. Especially in this current economic client, many of us are dreaming of living debt free.

- Home Ownership: Clearing your mortgage means owning your home outright, offering peace of mind and a sense of personal pride. Your home is also a significant asset that can serve as a financial safety net or be leveraged for other investments in the future.

- Interest Savings: Every dollar you put towards your mortgage reduces the principal amount, leading to substantial interest savings over the life of the loan. Paying off your mortgage early can potentially save you thousands of dollars in interest payments.

- Flexibility and Reduced Financial Stress: Being mortgage-free provides greater flexibility in your finances. If you are simply choosing to offset your mortgage, you will have the ability to fall back on these savings should you need. This will mean reducing financial stress and increasing your overall financial security.

Considerations and Trade-offs

While both strategies offer compelling benefits, there is no right or wrong answer. You should consider your overall financial situation, and consult a financial adviser before determining what avenue is the best fit for you. Some key considerations are:

- Time Horizon: Your age, proximity to retirement, and overall financial goals should influence your decision. If retirement is decades away, you might want to prioritise debt reduction as a more immediate goal, rather than locking additional funds up in super. Conversely, if you’re nearing retirement age, you may need to focus more on building your super, or even find a happy medium between both strategies.

- Risk Tolerance: Consider your risk tolerance and investment preferences. Superannuation investments are subject to market fluctuations, while paying off your mortgage offers a more stable return on investment, and can reduce expense anxiety. Considering the current economic climate can also be important.

- Diversification: Diversifying your financial strategy is key to mitigating risk and maximising returns. A well-diversified approach that includes both super contributions and mortgage repayment may offer the best of both worlds.

The choice between making additional super contributions and paying off your mortgage early is a personal one that depends on your individual circumstances and financial goals. Both strategies have their merits, and the optimal approach may involve a combination of the two. Ultimately, seeking professional financial advice can help you develop a tailored plan that aligns with your long-term objectives and ensures a secure financial future.

Want a Complimentary Consultation?

Fill in the form for a complimentary consultation with a Financial Adviser and start living your best possible life.

What you need to know: This information is provided by Invest Blue Pty Ltd (ABN 91 100 874 744). The information contained in this article is of general nature only and does not take into account the objectives, financial situation or needs of any particular person. Therefore, before making any decision, you should consider the appropriateness of the advice with regards to those matters and seek personal financial, tax and/or legal advice prior to acting on this information. Read our Financial Services Guide for information about our services, including the fees and other benefits that AMP companies and their representatives may receive in relation to products and services provided to you.These clients have agreed to share their stories. Everyone’s situation is different, so their choices and outcomes will be different to yours. Consider your circumstances before deciding what’s right for you.

Posted in Budgeting & Goals