Liberation Day Tariff Turmoil

April 7th 2025

Late last week US President Donald Trump announced his Liberation Day trade policy, with wide-ranging tariff increases at the heart of the announcement.

While he had flagged tariff changes were coming, markets were shocked at the extent and severity of them. The announcements were at the upper or worst case scenario end of market expectations.

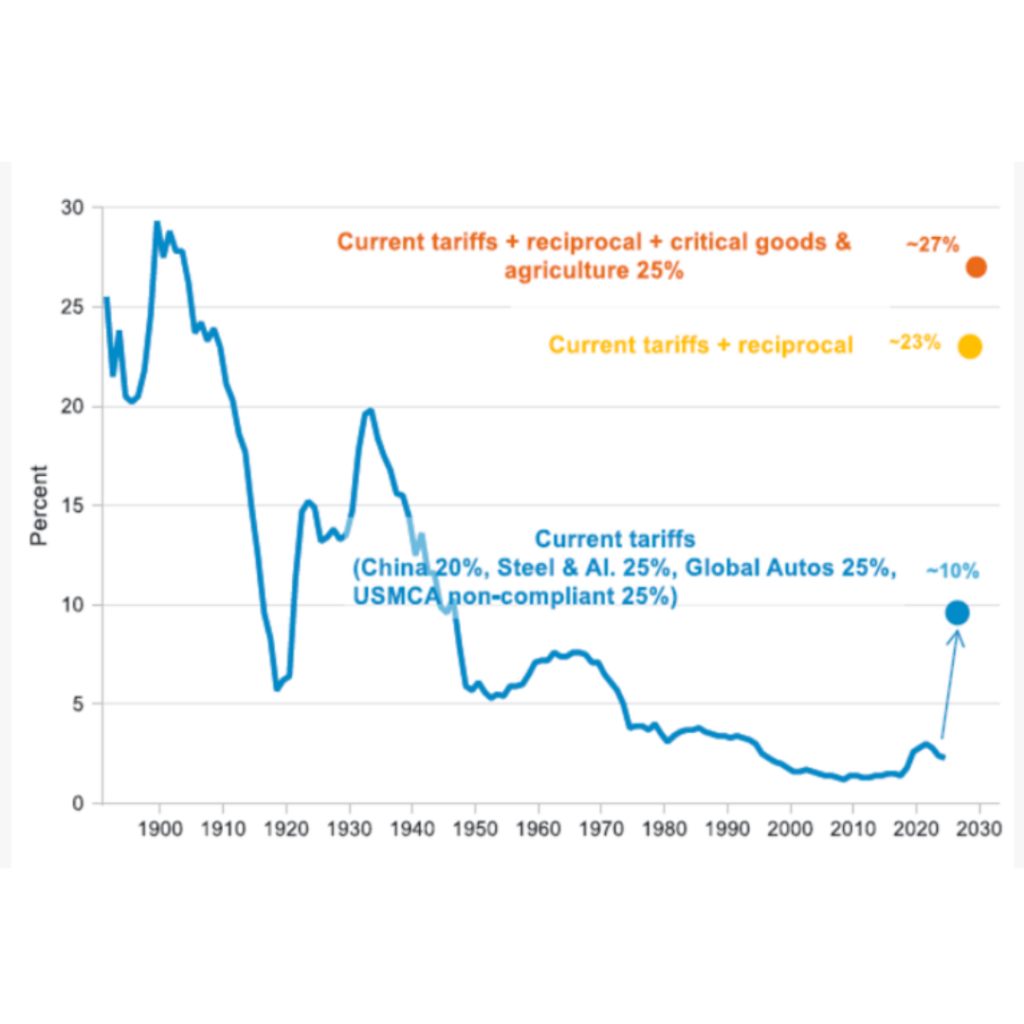

The effective tariff rate on US imports, as announced, will now seemingly rise to about 23-24%. The highest level in over a century.

Both the severity of the tariffs and their almost immediate introduction create an uncertain outlook for companies and the global economy.

Swift and steep falls have occurred now in all global stock markets.

Markets hate uncertainty – and right now they are feeding off it. After a 12–18-month period of strong performance and general stability, we are now facing a period of elevated volatility.

Tariffs explained

Tariffs (also known as import duties) are simply a tax imposed on imported goods and or services from another country. Thus, making those imports more expensive for businesses and consumers.

Tariffs had been largely phased out over the last century as the global economy embraced free trade and the benefits of it. Last week’s announcements impact that established world trading order. This has triggered “tit for tat” responses from impacted trading partners, such as China.

A lose/lose outcome…

The graph below highlights the changing nature of tariffs over the last 150 yrs.

Note: *USMCA non-compliant imports include 25% tariff on ~10% imports from Mexico and 20% imports from Canada and 10% tariffs on oil imports from Canada. Global autos do not include any exemption for value add from US made parts. Source: Fidelity International, Macrobond, United States International Trade Commission, April 2025.

The tariff announcements stipulate a minimum 10% imposition on imported goods into the USA. However, these have been topped up on certain trading partners, for a variety of reasons, in a more punitive way. Some notable countries and regions include:

- China 54%

- Vietnam 46%

- Taiwan 32%

- India 26%

- Japan 24%

- Germany, Italy and France circa 20%.

- Australia at this point has a 10% tariff imposed.

So, why impose new tariffs?

President Trump is of the belief that America has been “short-changed” by free trade and wants to effectively reindustrialize the USA. Creating jobs, rebuilding manufacturing, increasing investment and bringing wealth back to the USA. Making the USA less vulnerable to supply shocks and increasing national security.

In other words, “Making America Great Again”.

Additionally, he has promised business and personal tax cuts and expressed a desire to further deregulate the economy. That’s all before managing the huge $36.5 trillion public debt.

You could be forgiven for thinking he would like the rest of the world to fund his economic agenda through his new tariff regime…

What will happen next?

Almost certainly a lot of negotiating and deal-making. Countries have the option to retaliate or negotiate. The Trump camp have already signaled a willingness to “listen” to their trading partners. Many are opening dialogue with the USA and are hopeful of better outcomes through negotiation. Others like China have retaliated swiftly.

Whilst tariffs will remain, the amount of the tariff and the terms associated with them is not fully cast in stone. The situation remains fluid, and we will know more in the days, weeks and months ahead.

Self-interest is an incredibly strong motivator. No President wants to see their political legacy or economy get badly damaged if it can be avoided.

Leaving all the posturing and rhetoric aside – this should not be underestimated. What has been said and what will ultimately be done, may be two very different things.

All of us are looking for some form of economic common sense to prevail. If it does – this could easily fuel more positive investor sentiment and see markets move back in our preferred direction.

Volatility will persist at elevated levels and markets will react swiftly to news flow and economic data in the short term. We will see our good and bad days on the markets as they try and price in likely outcomes and find fair value. This can be unnerving for even the most seasoned investor. It’s important to remember some of the truly great days on the market happen when you least expect it.

How will the economy be impacted

This is the exact issue markets are grappling with.

The biggest fear is that the global economy will slide into recession. The risks of recession a few weeks ago were seen by many as being around 25-40%. The risks have clearly risen over the past week. Many now place this at a 40-60% likelihood. Markets are in the process of pricing this in.

A swift and sensible resolution to the tariff dramas of the last week is key to lowering recession risk. The longer the uncertainty prevails, and the longer confidence is dented, the greater the risk of companies and consumers pulling back and in doing so seeing economic growth retreat.

There is the risk of inflation taking hold again, just as the recent battle to tame it was nearly won. The impact of tariffs on the cost of goods will see prices rise, which could place upward pressure on interest rates.

Having said that, it’s increasingly likely that the uncertainty and loss of confidence feeds through to lower growth and provides Central banks with the ammunition to cut interest rates. Many are now predicting the Reserve bank is likely to cut rates more aggressively than was the case just a few weeks back.

We will find a “new economic normal” as the dust settles on this event. There are other tools available to Central Banks and Governments to promote growth. Economies will adapt and find new opportunities for growth.

The cycle will continue.

What should I do?

Remain calm.

These events occur from time to time and whilst they are extremely unsettling – we get through them and come out the other side.

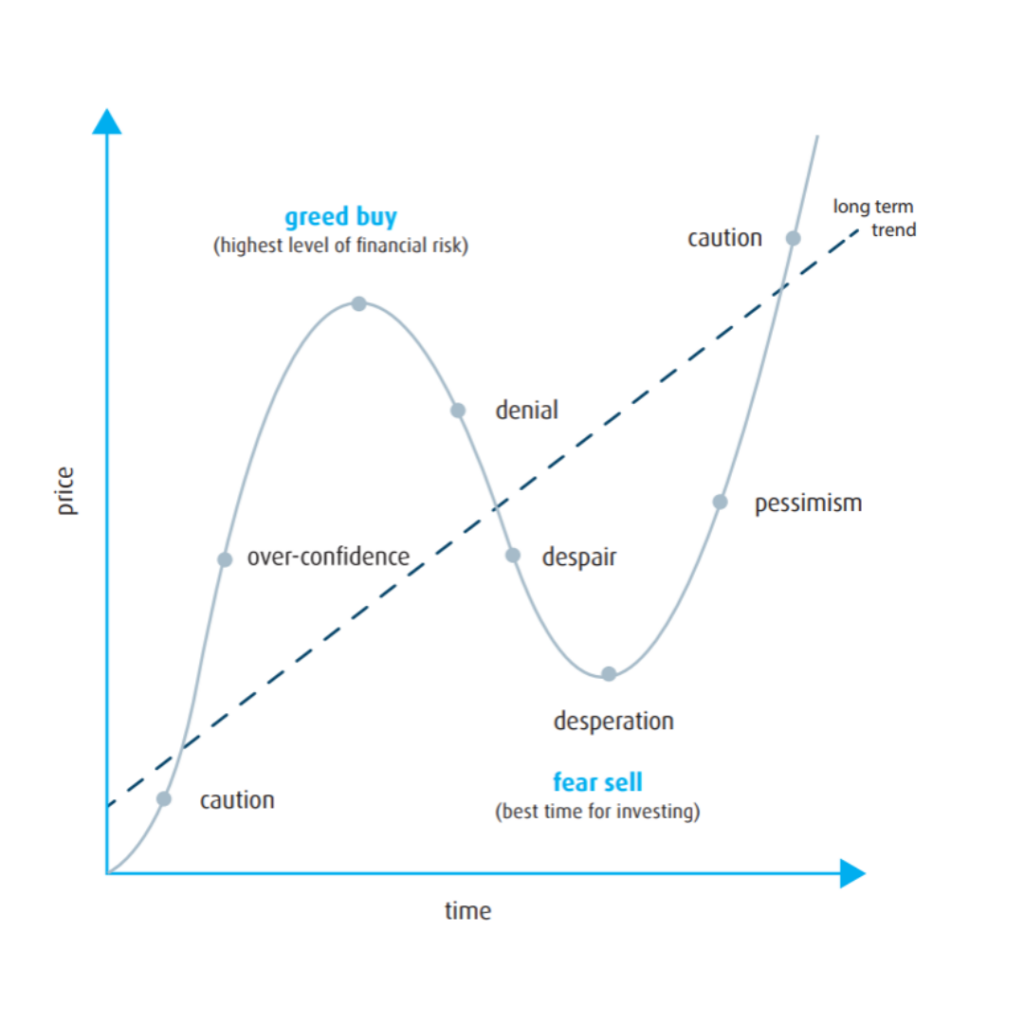

Cycle of Investor Emotions

Warren Buffet’s famous saying “Be fearful when others are greedy and be greedy when others are fearful” is well worth remembering.

It’s often-said – markets climb the stairs or the wall of worry on the way up and catch the elevator on the way down. It’s important to remember we spend 80+% of the time climbing and we will resume our climb again sometime soon.

Events like this bring opportunity. Just cast your mind back to the COVID crisis. Markets sold off violently on fear and concerns at the time, yet they survived and indeed thrived in the aftermath.

Growth assets reward patience. Investing in shares and other growth assets has historically delivered higher returns over time, while more defensive investments like cash and bonds help cushion short-term volatility.

Consider these key points:

- Markets recover — While short-term declines are expected, long-term trends have remained upward.

- Growth outperforms — Historically, shares have outpaced inflation and outperformed defensive assets.

- Timing the market is risky — Missing even a few key rebound days can significantly reduce long-term returns. These rebound days often happen when you would least expect it.

Our financial plans are all-weather. Whilst we don’t know the catalyst for events like this, nor when they will occur, we do know they will happen.

Diversification, staying invested, ignoring the noise, managing risk and having high quality investment partners working for you are all essential ingredients for enduring investment success.

Now is not the time to make rash or emotive decisions in fast-moving and volatile markets. One of the greatest destroyers of wealth is when people capitulate and turn a temporary “paper loss” and into a real and permanent one. Stay strapped in with your seatbelt fastened. Stick to your well laid plan.

We will keep you updated as developments unfold. If you have any questions, please reach out to your adviser to discuss your situation.

We are here to help, and all in this together.

A bit about Chris

Chris holds a Bachelor of Economics and is a Certified Financial Planner with over 25 years of experience. Chris has led industry committees and boards and has been instrumental in designing, building and managing wealth and investment solutions for Invest Blue and their clients for the past 15 years.

Chris is a happily married father of two and more recently, a grandfather. Away from work and family, he tries to keep his golf handicap at a respectable level and is an avid supporter of the Parramatta Eels (NRL) and Sydney Swans (AFL). He’s a sucker for a good bottle of red wine and has a long travel bucket list he and his wife are actively working their way through.

Chris Ogilvie

Chief Investment Officer

Connect with Chris on Linked In.

Source: Russel Investments

Important note: Market Week in Review is a weekly market update on global investment news in a quick five-minute video format. It gives you easy access to some of our top investment strategists. Watch every Friday, and our experts will keep you informed of key market events and provide you with an easy-to-understand outlook on the week ahead. Join industry leaders Erik Ristuben, Paul Eitelman, Adam Goff, Mark Eibel, and other industry-leading experts.