Australian Economy Update March 2018

March 13th 2018

Key points

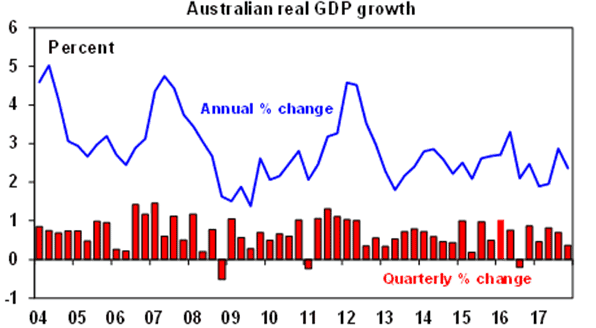

- The Australian economy grew 2.4% through 2017, good but well below potential given high population growth.

- There is a good reason to expect growth to continue and pick up a bit: the drag from falling mining investment is nearly over, non-mining investment is turning up, public investment is strong, the trade should add to growth and profits are rising. But growth is likely to be constrained to just below 3% this year and underlying inflation is likely to remain low.

- We don’t expect the RBA to start raising rates until 2019 (we were looking for a hike late this year). Australian shares are likely to move higher by year-end, but might continue underperforming global shares.

If you want to prepare for what’s to come, contact one of our advisers today.

[ninja_form id=37]

Growth just muddling along

For the last few years, the Australian economy has been meandering between 2-3% growth. This remained the case through last year with December quarter GDP up just 0.4%, and annual growth of 2.4% as a bounce a year ago dropped out. In the quarterly growth was helped by consumer spending and public investment but soft housing and business investment and a large detraction from net exports weighed on growth.

Australia continues to defy recession calls. Against this, economic growth is well below potential, with per capita growth running at just 0.8% year on year, which is below that in most major countries.

The usual worry list

Global threats aside, Australia’s worry list is well known:

- The solid contribution to growth from housing construction seen over 2013-16 has faded and building approvals are off their highs.

- Average house prices have started to edge down, with fears of a deeper crash. But in the absence of a stronger supply surge, the Reserve Bank of Australia (RBA) making a mistake and raising rates too high and/or unemployment surging, our view remains that price declines in Sydney and Melbourne will be limited to 5-10% and other cities face a more positive outlook.

- The outlook for consumer spending is constrained and uncertain given record low wages growth, high levels of underemployment and slowing wealth gains. Consumers have been running down their savings rate helped by rising wealth (to now just 2.7%), but this is unlikely to continue as property prices in Sydney and Melbourne slow.

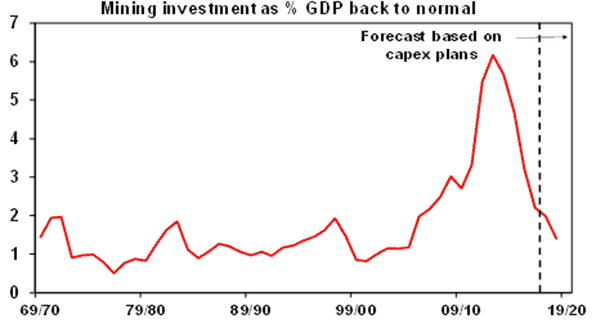

- Mining investment is still falling with investment plans pointing to roughly 15% falls this financial year and next.

- The Australian dollar at around $US0.78 is up 12% from its 2015 low and risks threatening growth in trade-exposed sectors like tourism, agriculture and manufacturing.

- Underlying inflation is too low with a fall in inflationary expectations, making it harder to get wages growth up and with the stronger $A not helping.

- Our political leaders seem collectively unable to undertake productivity-enhancing economic reforms. And it’s unlikely this will change anytime soon which is a concern with productivity falling 0.8% through 2017.

Five reasons why growth will be okay

These drags are nothing new. We continue to see five reasons why recession will be avoided, and growth will be okay:

- First, the drag from falling mining investment is nearly over. Mining investment peaked at nearly 7% of GDP five years ago and has since been falling, knocking around 1.5% pa from GDP growth. At around 2% of GDP now, its growth drag has fallen to around 0.3% pa and it’s near the bottom.

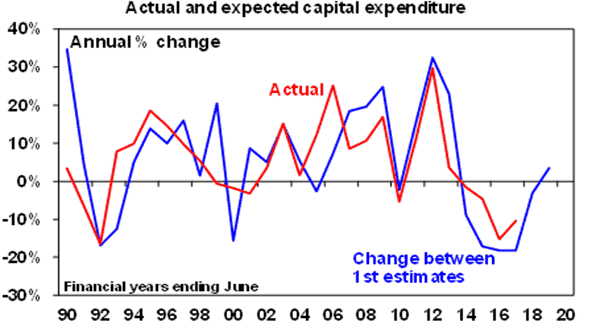

- Second, non-mining investment is now rising. Comparing corporate investment plans for this financial year with those made a year ago points to a decline in business investment this year of around 3% (see next chart) and a similarly sized rise in 2018-19. But this is the best it’s been since 2013 & once mining investment is excluded this turns into an 8% gain for non-mining investment in both years.

- Third, public investment is rising strongly, reflecting state infrastructure spending.

- Fourth, net exports are likely to add to growth as the completion of resources projects and strong global demand boosts resources export volumes and services sectors like tourism and higher education remain strong.

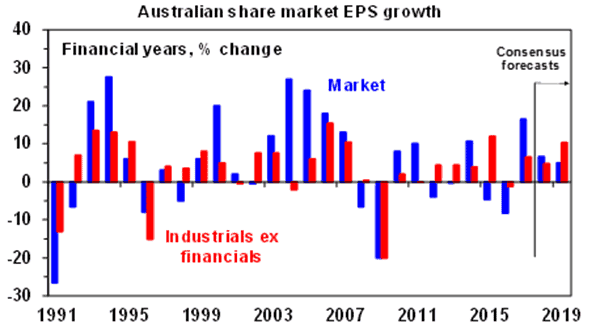

- Finally, profits for listed companies are rising. This is a positive for investors.

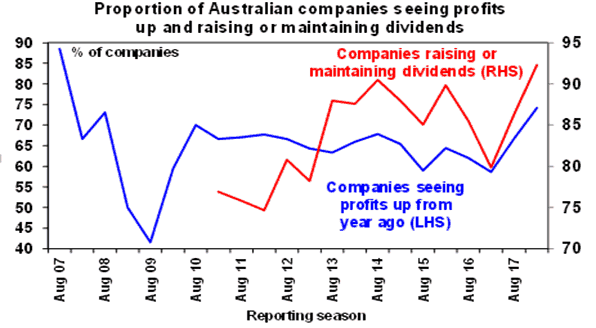

While profit growth has slowed from 16% in 2016-17 to around 7% now as the 2016-17 surge in commodity prices dropped out, more companies (74%) are seeing profit gains than at any time since before the GFC. 92% of Australian companies either raised or maintained their dividends in the most recent reporting season indicating a high degree of confidence in the earnings and growth outlook.

So while housing is slowing and consumer spending is constrained (with January retail sales data suggesting consumer spending this year is off to a weak start), a lessening drag from mining investment and stronger non-mining investment (both public and private) along with solid export growth are likely to keep the economy growing and see a pick-up in growth to between 2.5% and 3%. However, growth is likely to remain below Reserve Bank of Australia expectations for a pick up to 3.25% this year and next. As a result, and with wages growth and inflation likely to remain low for a while yet we have pushed out the expected timing for the first RBA rate hike from late this year into February next year.

Implications for investors

There are several implications for Australian investors.

First, continuing growth should provide a reasonable backdrop for Australian growth assets. Australian shares are vulnerable to the concerns impacting global markets – particularly US inflation and Fed fears and worries about a trade war – but we remain of the view that the ASX 200 will be higher by year-end.

Second, bank deposits are likely to provide poor returns for investors for a while yet. The issue for investors in bank deposits is to think about what they are really after. If it’s peace of mind regarding the capital value of their investment, then maybe stay put. But if it’s a decent income yield then there are plenty of alternatives providing superior yield. The yield gap between Australian shares and bank deposits remains wide.

Third, while Australian shares are great for income, global shares are likely to remain outperformers for capital growth. Global shares have been outperforming Australian shares since October 2009 and over the last five years have outperformed in local currency terms by nearly 4% pa and by 9% pa in Australian dollar terms. This reflects relatively tighter monetary policy in Australia, the commodity slump, the lagged impact of the rise in the $A above parity in 2010, and a mean reversion of the 2000 to 2009 outperformance by Australian shares. While earnings growth in Australia is around 7%, it’s double this globally, suggesting the relative underperformance of Australian shares in terms of capital growth may go for a while yet. Which all argues for a continuing decent exposure to global shares.

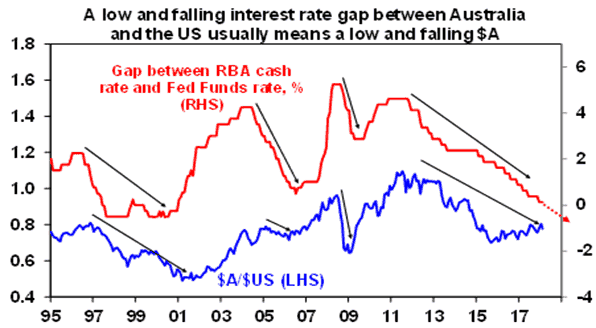

Finally, the risks remain on the downside for the $A. With the RBA comfortably on hold and the Fed set to raise rates later this month with four hikes this year in total, the interest rate gap between Australia and the US will go negative and keep falling this year. Historically this has been associated with falls in the value of the Australian dollar. Fears of a global trade war may add to this risk given Australia’s relatively high trade exposure. All of which is another reason to maintain a continuing decent exposure to global shares but on an unhedged basis.

Ensure your financial security and speak with an adviser today.

[ninja_form id=41]