5 reasons why returns for investors are likely to be solid in 2017-18

July 20th 2017

Key points

Despite a lengthy list of worries including Brexit, Trump and messy Australian growth, the past financial year saw strong returns for diversified investors as shares recovered from a rough time in 2015-16.

Key lessons for investors from the last financial year include: turn down the noise around financial markets, maintain a well-diversified portfolio; be cautious of the crowd; and cash continues to be a poor generator of returns.

Returns are likely to slow this financial year but remain solid. Global growth is good, this should underpin profit growth, there are minimal signs of broad-based economic excess that point to a peak in the global growth cycle, global monetary policy is likely to remain relatively easy despite a gradual tightening and share valuations are not excessive.

If you would like to discuss your investments in further detail, get in touch.

[ninja_form id=37]

Introduction

The past financial year turned out far better for investors than had been feared a year ago. This was despite a lengthy list of things to worry about: starting with the Brexit vote and a messy election outcome in Australia both just before the financial year started; concerns about global growth, profits and deflation a year ago; Donald Trump being elected President in the US with some predicting a debilitating global trade war as a result; various elections across Europe feared to see populists gain power; the US Federal Reserve resuming interest rate hikes; North Korea stepping up its missile tests; China moving to put the brakes on its economy amidst ever present concern about its debt levels; and messy growth in Australia along with perennial fears of a property crash and banking crisis. Predictions of some sort of global financial crisis in 2016 were all the rage. But the last financial year provided a classic reminder to investors to turn down the noise on all the events swirling around investment markets and associated predictions of disaster, and how, when the crowd is negative, things can surprise for the better. But will returns remain reasonable? After reviewing the returns of the last financial year, this note looks at the investment outlook for the 2017-18 financial year.

A good year for diversified investors

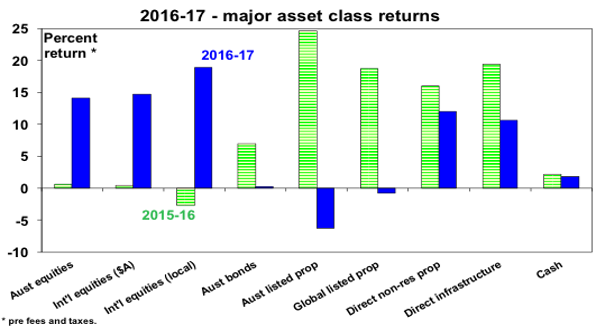

The 2016-17 financial year provided strong returns for diversified investors. Of course cash and bank term deposits continued to provide poor returns and a backup in bond yields, as deflation and global growth fears faded, resulted in poor returns from bonds and investments that are sensitive to rising bond yields such as real estate investment trusts. But improving global growth and profits along with still easy monetary policy buoyed share markets with global shares continuing to outperform Australian shares. And real assets like unlisted (or direct) commercial property, infrastructure and Australian residential property continued to perform well, although there was a huge range across Australia in terms of the latter with Perth depressed and Sydney and Melbourne still booming.

Source: Thomson Reuters, AMP Capital

As a result, balanced growth superannuation funds returned around 10% after fees and taxes over 2016-17, in contrast to depressed returns of around 2% in 2015-16. Interestingly, such funds returned around 10% pa over the last five years as well reflecting favourable asset class returns partly in response to a recovery from the 2010-12 Eurozone sovereign debt crisis.

Key lessons for investors from the last financial year

These include:

Turn down the noise – despite lots of worries and predictions of disaster shares did well.

Maintain a well-diversified portfolio – despite previous strongly-performing asset classes like bonds real estate investment trusts having a tougher time, a well-diversified portfolio benefitted from a rebound in share markets.

Be cautious of the crowd – a year ago the crowd was pretty negative and as is often the case it turned out to be wrong.

Cash is not king – while cash and bank deposits provided safe steady returns, they were also very low returns.

Five reasons why returns are likely to remain solid

Of course, there will be the usual corrections and bumps along the way. However, there are five reasons to be upbeat about the overall return outlook for the year ahead.

First, global growth is solid. Business conditions indicators – such as surveys of purchasing managers (Purchasing Managers Indexes or PMIs) – are strong and at levels consistent with good global growth.

Source: Bloomberg, AMP Capital

In Australia, growth is unlikely to be fantastic as housing slows and the consumer is constrained but it should still be okay as the big drag from falling mining investment is abating and the contribution to growth from trade is set to remain solid as resources projects complete.

Second, solid global growth should continue to underpin a recovery in corporate profits after a weak patch into 2016.

Third, there are minimal signs globally of the broad-based excess – in terms of capacity utilisation, growth in debt, investment, wages growth and inflation or asset prices – that normally presage a peak in the growth cycle. Sure, there have been pockets of excess – corporate debt growth has been arguably too strong in the US and China, and the Sydney and Melbourne property markets have been too hot – but they have not been broad based, unlike the share boom and tech related investment into say 2000.

Fourth, because of low inflationary pressures, global monetary tightening will likely remain very gradual and monetary policy will likely remain easy for some time to come. There is a risk that the next Fed rate hike won’t occur until 2018, the ECB’s exit from ultra-easy monetary policy will likely be very slow, the RBA is still some time away from tightening and Bank of Japan tightening is likely years away.

Finally, share valuations are not excessive. While price to earnings ratios are a bit above long-term averages, this is not unusual for a low inflationary environment. Valuation measures that allow for low-interest rates and bond yields show shares to no longer be as cheap as a year ago but they are still not expensive, particularly outside of the US.

What about the return outlook?

After the strong overall investment returns seen over last year, some slowing is likely in the year ahead. Share markets are no longer universally cheap and the crowd is not as negative as a year ago. However, putting short-term worries and uncertainties aside, with reasonable economic and profit growth, continuing relatively easy monetary policy and some asset classes still benefitting from a chase for yield, returns from a well-diversified portfolio are likely to be reasonable this financial year – but more like 7% as opposed to 10%. Looking at the major asset classes:

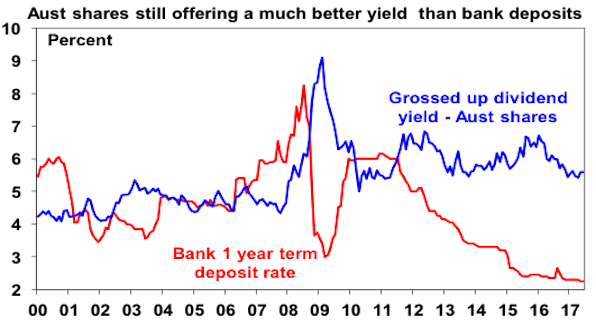

- Cash and term deposit returns are likely to remain poor at around 2%. Investors are still under pressure to decide what they really want: if it’s complete capital stability then stick with cash or if it’s a decent stable income flow then consider the alternatives with Australian shares and real assets such as unlisted commercial property likely to continue to offer more attractive yields than bank deposits.

Source: RBA, AMP Capital

- Still ultra-low sovereign bond yields and a likely gradual rising trend in yields, which will result in capital losses, are likely to result in another year of poor returns from bonds.

- Corporate debt should provide okay returns. A drift higher in sovereign bond yields is a mild drag but with continued modest global growth the risk of default should remain low.

- Unlisted commercial property and infrastructure are likely to benefit from the ongoing “search for yield” (although this may slow a bit) and solid economic growth.

- Residential property returns are likely to be mixed with Sydney and Melbourne slowing, Perth and Darwin bottoming and other cities providing modest gains. Very low rental yields are not good, particularly in oversupplied units.

- Expect a potential share market correction in the seasonally weak period out to October, but the rising trend in shares is likely to continue as shares are okay value, monetary conditions are likely to remain relatively easy (albeit becoming less so) and continuing reasonable economic growth should help profits. We continue to favour global shares (particularly outside the US) over Australian shares.

- Finally, while the $A has proved far more resilient than I expected and may push up into the low $US0.80s in the short term, the downtrend in the $A is likely to resume at some point in the next 12 months enhancing the case for unhedged global shares.

Things to keep an eye on

The key things to keep an eye on over the year ahead are:

- Global business conditions PMIs – these currently point to good, but not booming, growth.

- Risks around President Trump – we see Congress passing tax reform but there’s a risk the noise around Trump will overwhelm.

- The US Federal Reserve’s likely winding down of its balance sheet (reversing quantitative easing) along with a possible transition to a new Fed Chair could cause volatility.

- The Italian election due by May 2018 could reinvigorate Eurozone break up fears.

- The European Central Bank is likely to slow its monetary stimulus next year.

- North Korean risks could escalate.

- The Sydney and Melbourne property markets – where a sharp downturn (which is not our view) could threaten Australian growth.

Concluding comments

This financial year will likely see the usual worry list and bouts of volatility and returns may slow from 2016-17, but the combination of reasonable global growth, solid profit growth and still easy monetary conditions suggest solid returns for diversified investors.

If you would like to discuss how any of these issues might impact your investments or goals, get in touch with our team.

[ninja_form id=41]

Important note: While every care has been taken in the preparation of this article, AMP Capital Investors Limited (ABN 59 001 777 591, AFSL 232497) and AMP Capital Funds Management Limited (ABN 15 159 557 721, AFSL 426455) makes no representations or warranties as to the accuracy or completeness of any statement in it including, without limitation, any forecasts. Past performance is not a reliable indicator of future performance. This article has been prepared for the purpose of providing general information, without taking account of any particular investor’s objectives, financial situation or needs. An investor should, before making any investment decisions, consider the appropriateness of the information in this article, and seek professional advice, having regard to the investor’s objectives, financial situation and needs. This article is solely for the use of the party to whom it is provided.