Is now a good time to invest in the property market?

May 14th 2020 | Categories: Investing |

Impact of COVID-19 on the property markets in Australia

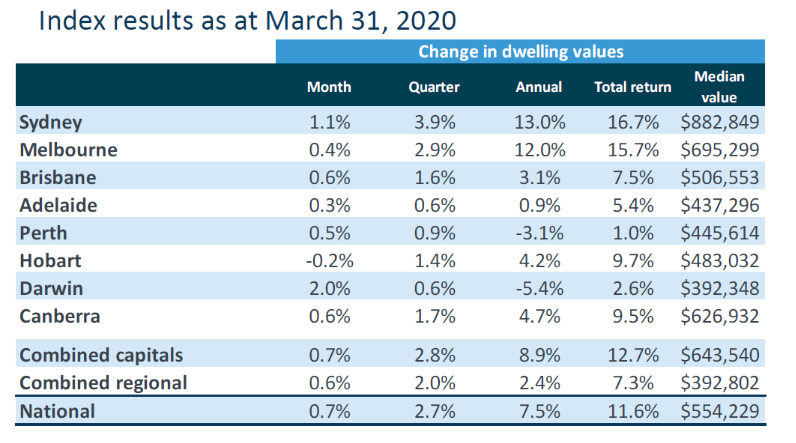

The real estate prices in Australia have been a steady market for the past couple of years. According to recent reports, the average price of houses across Australia went up by 7.5% between March 2019 to March 2020.

In the recent months since the outbreak of the Coronavirus, most of the metropolitan cities still reported a small increment in the property values, with Sydney reporting an increase of 3.9% in housing values, Melbourne 2.9%, and Canberra 1.7%.

These gains have started to be stunted by ongoing unemployment, dented consumer confidence, and purchasing power. The dwindling state of the economy has started demonstrating its repercussions. Growth rates have already fallen from 6.6% for the quarter ended December 2019 to 3.6% for the quarter ended March 2020.

The detrimental effects of COVID-19 are seen to be far more damaging than the global recession of 2008. It is because of the uncertainty associated with a health-related emergency compared to a financial emergency. The purchasers do not know the extent of the impact yet and how long the economy will remain shut. Therefore, owing to the uncertainties, rapidly declining economy, and strict social-distancing rules, the housing prices are plunging across the country and the world.

Economists predict prices will fall by 30% due to economic impacts of the pandemic but are expected to rebound quickly.

Read our article for landlords impacts by the Coronavirus

Understand how a financial adviser can support you with your need for financial security. Get in touch.

[ninja_form id=37]

Is it advisable to buy into the property market in the current times?

As a result of COVID-19 impacts on the economy and the associated uncertainty, buyers in the property markets are majorly pulling back, taking the momentum out of the market. A lot of buyers have their wealth tied up in the equity markets, while many others are facing a cash crunch due to loss of jobs, pay cuts, and lack of income growth.

Moving is considered an essential service under the current restrictions we have in Australia, but you will not be able to attend an open house or auction in person. Most buyers are relying on virtual inspections to do the heavy lifting only inspecting in person as a last resort and under social distancing guidelines. Restrictions in this area are expected to ease slightly early-mid May.

Therefore, overall, buying into the housing markets has been reduced. However, with the low housing prices and low-interest rates, this could be a good time to buy into the property market for those who can afford it. Supply has eased along with demand, but there are still potential deals to be had. April saw average prices rise slightly, but overall settlement rates have dropped by about 40 per cent. With unemployment rates expected to rise, rental demand expected to fall, immigration halted and foreign investment expected to be lower than normal, there is plenty to indicate that prices could drop. The question remains, what will demand do? If there are still people out there with the capacity to buy, they could continue to hold the market steady.

Housing prices may take a hit in the short term, but a strong rebound is expected by 2021. The buyers may be able to secure a good price in the current property market; however, any buying decision needs to be backed with thorough research.

Read our market update on the Coronavirus and the economy and the threat to Australian house prices from the Coronavirus.

What to Research Before Buying into the Property Market

Your research before investing in the property market at this time should cover two essential dimensions. The first aspect is the external research into the markets, availability of best prices, interest rates, and online bidding and auctions. Australia has a vast number of housing markets, and each market will be affected differently.

Therefore, a thorough analysis of specific property markets is the correct approach before investing in housing markets in the current economic climate. You should play safe and not make long-term property investment decisions based on a ten-minutes news snippet.

Consider the location: some areas will be hit harder than others, and some inherently have more volatility due to demand. You may need to pick a location for reasons other than investment criteria, but within that market, it pays to understand which types of homes tend to be more resilient in market downturns.

The second, and more critical, aspect of research before buying into the property market is the inward research. Your decision to buy, not to buy, where to buy, when to buy, and what to buy is highly personal and will vary from person to person, depending on your individual financial goals.

The significant factors to be considered should include age, number of dependents, availability of stable employment, risk appetite, investment horizon, and financial security. Based on the current situation, there is more risk than normal when it comes to making a big commitment like purchasing real estate. Consider whether your future medical emergencies, financial demands, and other life uncertainties have been factored in.

The Bottom Line

COVID-19 has caused immense uncertainty, loss of jobs, and stock market crashes, and a gloomy storm overall. The economy has been trampled over, and the revival may take months or even years.

However, buying into the property market can actually be a smart thing to do. It is encouraging to understand that although the housing prices are uncertain right now, they may start rising again after the crisis and uncertainty is over. COVID-19 is only expected to cause short-term disruption in the property market, rather than a long-term loss in value.

Therefore, buying into the property market can work well for you if you have the financial stability to afford the purchase and still maintain financial security in the future. The investment in housing markets is ideal for investors looking at potential appreciation rather than those looking at short-term returns and cash flow.

Although, you must ensure that a buying decision in the current climate deserves careful consideration of both the pros and cons. A thorough analysis of the external factors as well as the internal factors is a prerequisite to safeguard your financial state during the present tumultuous times. If your decision is purely investment based, there may be other alternatives carrying less risk. It pays to discuss your options with a financial adviser to weigh out your options, pros and cons, and to ensure that your investment strategy and portfolio align to your personal values and goals.

If you would like to discuss your financial situation, we are happy to assist. Contact us today.

[ninja_form id=41]

What you need to know

This information is provided by Invest Blue Pty Ltd (ABN 91 100 874 744). The information contained in this article is of general nature only and does not take into account the objectives, financial situation or needs of any particular person. Therefore, before making any decision, you should consider the appropriateness of the advice with regards to those matters and seek personal financial, tax and/or legal advice prior to acting on this information. Read our Financial Services Guide for information about our services, including the fees and other benefits that AMP companies and their representatives may receive in relations to products and services provided to you.

Posted in Investing