Is Debt Consolidation a good idea?

June 19th 2020 | Categories: Debt Management |

What is Debt Consolidation?

The process of taking a new single loan to pay off multiple liabilities is termed as debt consolidation. It helps to combine multiple debts into one larger loan.

Debt consolidation does not erase or reduce debt obligations. It simply places them with a single lender rather than various lenders. For instance, you may have multiple personal loans and a credit card debt that can all be consolidated into a single loan. Debt consolidation loans generally have a lower interest rate than a lot of credit cards and personal loans making the repayments more affordable. However, in many cases, the term of the loan could be extended for a longer period than your existing loans.

Understand how a financial adviser can support you with your need for financial security. Get in touch.

[ninja_form id=37]

Benefits of Debt Consolidation

Debt consolidation could be advantageous to you if you are overwhelmed by juggling multiple repayments with different lenders. It not only rolls all the debts in one but may also help in reducing monthly payments. The benefits of debt consolidation include:

- Consolidation of Bills: The most significant benefit of debt consolidation is the combination of multiple bills into one. You will not receive numerous bills from different lenders and will only have to make one payment a month. This means that you do not have to keep track of the various bills and manage your finances more efficiently, keeping track of one payment deadline.

- Possibility of Lower Interest Rate: In most cases, the interest rate on a sizeable consolidated debt is lower than the interest rates on different debts individually. It happens due to the larger lump sum principal.

You can read more about how to take advantage of low-interest rates here.

- Stress Reduction: The consolidation of several smaller debts into one debt makes it easier to manage your finances. You can clear all the mental clutter and streamline payments, potentially reduce your repayments and as a result, potentially reduce your overall financial stress.

You may be interested in our article 5 tips to prevent debt stress getting you down

The Downside of Debt Consolidation

The perks of consolidating debt may sound too good to pass especially when you consider lower monthly repayments. But there are factors to consider before you decide to consolidate your debts.

- Interest Rates: Debt consolidation may help reduce the interest rates; however, it is essential to delve deeper into the terms and conditions before making a commitment. Some lenders may offer a promotional lower interest rate for the first 12-18 months but may inflate the interest rate at a later stage. Furthermore, there is no guarantee that the new interest rate will be lower than the current interest rates that you are paying on the smaller loans.

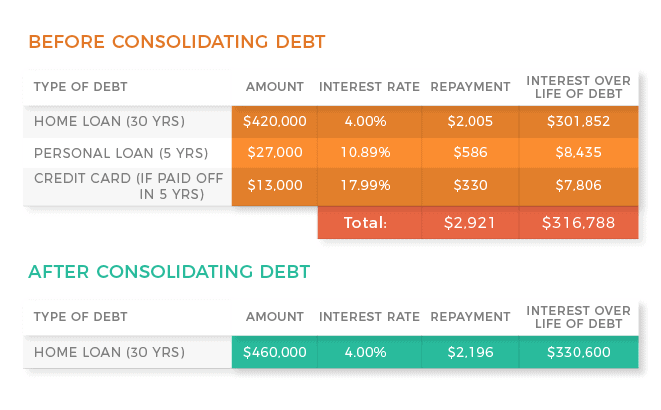

- Longer-term contract: Although your monthly payments may be reduced, the term of your loan may be a longer period than your original loans. Because of this, it could mean you end up paying more in interest in the long run over that of your original loan even though the interest rate is lower. As shown in the table below your monthly repayments may significantly decrease however the interest paid over your life of debt is higher because of the longer-term contract.

Source: Mozo

- Debt Consolidation Does Not Erase Your Debts: It is critical to understand that debt consolidation does not mean debt elimination. The debt gets restructured, reformed, and rearranged, but not erased. You still need to control your finances, payments and money behaviour to ensure that you don’t get deeper into the debt cycle.

- Eligibility to Qualify for Debt Consolidation: It is also essential for you to check if you are eligible for debt consolidation. Most of the lenders and debt consolidation providers consider it as a new and additional loan, even though you plan to close your existing loans and debts. Therefore, if you have an existing bad credit rating, are already in significant debt or you are negatively impacted by the current economic situation caused by the Coronavirus pandemic, you may not be able to get approved for debt consolidation.

For many, debt consolidation may become tempting when multiple payments become too expensive or overwhelming. It can be beneficial if you have a plan to utilize the low-interest rate to pay your loan off in a shorter amount of time than your original loan terms. Keep in mind that you could end up paying more if you agree to a longer-term long.

Before consolidating you should consider other options such as:

- Leverage your home equity. This means you can roll other debts into your mortgage.

- Quickly pay off one of your debts to eliminate the associated fees and repayments.

- Transfer your credit card balance to another credit provider with a lower interest rate.

You may also be interested in our article “spotlight on personal loans and how to repay your loan faster”.

Debt consolidation is an effective means to streamline your finances and bill payments. It works well by reducing multiple payments to one lump-sum payment, possibly at a lower interest rate, and may help to reduce financial stress. However, it is necessary to consider the loan costs, the credibility of the loan provider, and security of your assets and long-term life repayment amount before consolidating all your loans into one.

Speak to an adviser today to see how we can help you take control of your finances.

[ninja_form id=41]

What you need to know

This information is provided by Invest Blue Pty Ltd (ABN 91 100 874 744). The information contained in this article is of general nature only and does not take into account the objectives, financial situation or needs of any particular person. Therefore, before making any decision, you should consider the appropriateness of the advice with regards to those matters and seek personal financial, tax and/or legal advice prior to acting on this information. Read our Financial Services Guide for information about our services, including the fees and other benefits that AMP companies and their representatives may receive in relations to products and services provided to you.

Posted in Debt Management