Wealth Protection

Invest Blue is passionate about empowering people reach their goals and dreams by providing quality, tailored financial advice.

Our Beliefs

We are passionate about ensuring that the things which are most important to you and the goals you have set can still be achieved in the event of unforeseen circumstances, including serious illness, death, temporary or permanent disablement.

Our Approach

Our approach involves identifying key risks and implementing an appropriate cost-effective and tax-efficient solution to meet these contingencies. Our wealth protection plans, solutions and strategies are not “one size fits all”, but rather are unique, and based on your personal circumstances, which ensures greater suitability between you and the plan recommended. We take a consultative and strategic approach to recommending protection that takes into account your situation, the things that matter most to you, your needs and most importantly your objectives.

Insurance Needs

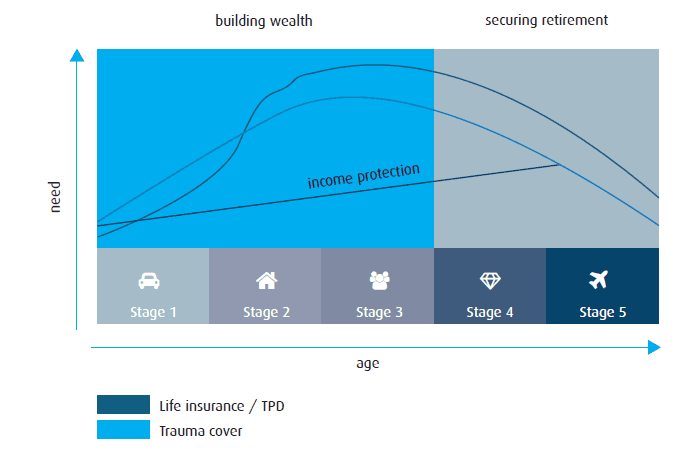

Your needs for insurance cover will change throughout your lifetime. As your financial obligations increase, so do your protection needs. Later in life as the value of your assets increase, and debts decrease, your insurance cover needs will likely decrease as well.

Specific factors we consider when determining insurance needs include, determining how much cover you need, managing or clearing debts, child care and/or education costs, potential medical care and rehabilitation costs and replacing income to meet general living expenses.

Our Services

Needs Assessment

Based on the information you have provided we will identify the insurance plan with appropriate features and benefits and necessary levels of cover, whilst at the same time balancing your competing priorities and how long you need to retain cover. In addition, we will ask some initial health and occupation questions before any cover is applied for. This will help determine if there are any factors we need to consider with various insurers to find you the most appropriate cover. Invest Blue have relationships with some of the country’s largest insurers so we can select appropriate leading plans from a broad range of insurance companies. We will review your existing insurance plans to identify any gaps, or instances of under or over insurance.

Written Recommendations

We provide a written recommendation based on features and costs. We will review the terms and conditions of the contracts, taking the time to help you understand them.

We only recommend reputable insurers that meet strict criteria surrounding their underwriting process, features and benefits, credit rating and importantly, claims experience.

To ensure the recommended sum insured can be achieved, we consider different ownership structures and their taxation implications. We then evaluate the merits of different payment structures relative to the amount of time you may require the protection.

We also consider the impact of insurance held in superannuation and the long-term effect of the insurance cost on your retirement savings. Where possible we develop strategies to mitigate any impact.

Application & Underwriting Process

Having agreed to implement our advice, Invest Blue will handle all of the administration and applications process for you on your behalf.

We are firm believers in underwriting at application where the insurer will evaluate your personal circumstances upfront to decide how much they will cover you for, how much you should pay for it, or whether even to accept the risk and insure you.

The underwriting process can be a daunting experience, with our help we will aim to make this process as seamless as possible.

Ongoing Review Service

At your progress meeting, we will discuss how you are tracking towards your goals and the potential impact any changes in lifestyle or circumstances may have on the appropriate level of your insurance cover and/or the insurance policy.

Claims Service

Should the need arise for a claim, we will work with you and the insurer to ensure this process is smooth.

Cost of our Advice & Services

The costs involved in preparing, recommending and implementing this service are agreed upfront between you and your adviser.

Take the first step towards the life you’ve imagined.