How risky is risk? How to find an investment you are comfortable with.

February 19th 2020 | Categories: Investing |

Ahhhh risk. It sounds scary, doesn’t it? How do you demystify it? What steps can you take to use it to your advantage? What is it all about? Or if we look at it in investment terms, how do you find a level of risk you are comfortable with? *Disclaimer: All information in this article is general in nature and does not take into consideration your specific situation, goals or desired outcomes. If you intend on applying any of the below information, we recommend working with a financial planner to create a plan that takes into your specific situation. Please get in touch to organise a complimentary initial meeting.

Introduction

Our investment philosophy states that risk is in fact about protecting your hard-earned money. It is therefore, not about chasing the highest returns, but about balancing reward (returns) with protecting portfolios balances. To avoid the pitfalls of rises and falls in share values, a less risky way of investing is to diversify your investments across a range of asset classes, a topic we explore further in this article. It is recommended that you work on your investment strategy with a skilled Professional Financial Adviser. When we talk about an investment strategy, we are generally looking at a medium to long term time horizon.

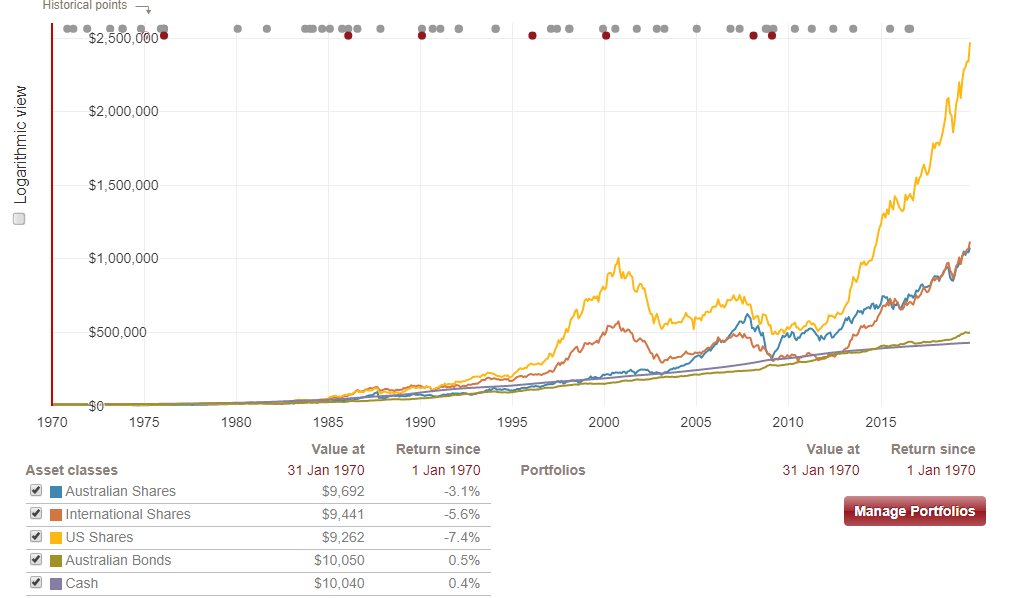

Figure 1: Vanguard Interactive Index Chart November 2019

You will see from this, that the return on Australian shares is 9.8% per annum on average, however, this assumes a deposit was made in 1970. It takes time to build returns on share investments. We cover this further in our recent Market Update. Back to risk, what is it exactly? Let’s go firstly to a dictionary definition: “noun. Risk is the possibility or chance of loss, danger orinjury[1]”. Now let’s go to an Adviser’s opinion: “Risk is the chance of you losing capital and not getting it back, or the risk of not growing your capital.” It’s enough to put anyone off! You can see from the Vanguard Chart however, that taking on some risk with the right investment strategy can yield returns.

How do you quantify risk?

In essence, the risk is about return on investment, and one way to quantify it is to look at past performance. However, it is important to understand that past performances are not indicative of future results. Economic factors need to be considered too however, as these will change things up dramatically. Take the Global Financial Crisis (GFC) of 2007-2008 as an example. If you had invested $10,000 in a diversified share portfolio 1989, at the time of the GFC you would have earned a healthy return. That would have halved by the end of the GFC; if you panicked and sold, you would realise your loss. However, if you retained your investments, no losses would have been actually incurred and the value of your investments would have increased and more than recovered today. It is difficult to know when the next market downturn will be. Past examples include:

- The great depression 1929-39

- The OPEC Oil price shock of 1973

- The Asian crisis of 1997

- 2000 – dot com bust

- GFC – 2007/2008

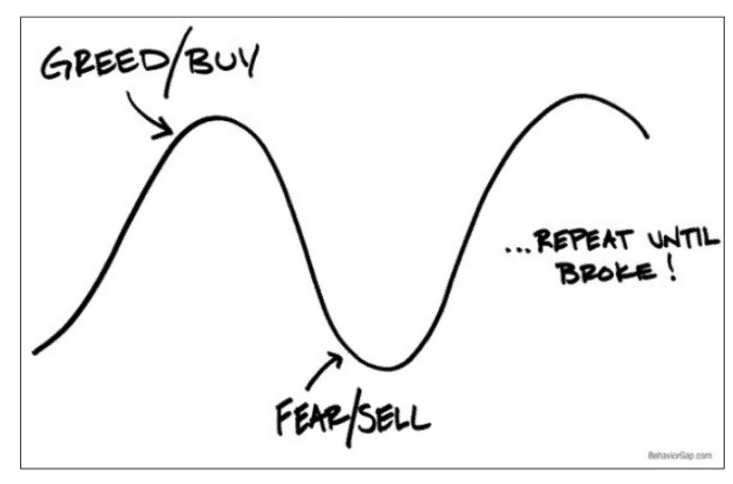

Who knows what will happen next, and when it does, if there is a correction coming. No one knows. The best way to weather the storm according to many astute investors is to hang in there! Let’s take a look at the ‘Greed and Fear’ graph. We also cover this in our Investment Philosophy. The image depicts common human behaviour. People expect past trends to continue, so they end up buying when the prices are high (greed-they see an investment performing well and want to join in) and selling when the prices are low (fear-they see an investment losing value and want out before it gets worse). This pattern of behaviour, however, has no bearing on the return from the market. It is based on emotional triggers. The desire to look around us for clues as to how to behave is deeply ingrained in our psychology. It is what has kept humans alive and evolving for millennia!

Figure 2: Greed and Fear Graph

Are you mimicking what others are doing? – following the market as opposed to working with it? A great recent example is bitcoin. Investors started buying after the big gains (the market was high) and the market suddenly collapsed, and investors panicked on the way down, selling off and realising their losses.

Working with the law of averages

Unless you have a very large risk appetite, it is likely that you will want to take a diversified approach to investing. The law of averages is the commonly held belief that a particular outcome or event will, over certain periods of time, occur at a frequency that is similar to its probability[2] Dollar-cost averaging is a risk management strategy. This is investing the same amount in a well-considered portfolio at regular intervals no matter what the market is doing. By participating regularly, you are buying in when the market is high and low, earning the market return over a long period of time, averaging out to realise the long-term gain and reducing the risk of trying to time the market. Are you ready to talk about investing with a Financial Adviser? Contact us today about how we can work with you to create wealth for your future.

[ninja_form id=37]

What is the right amount of risk?

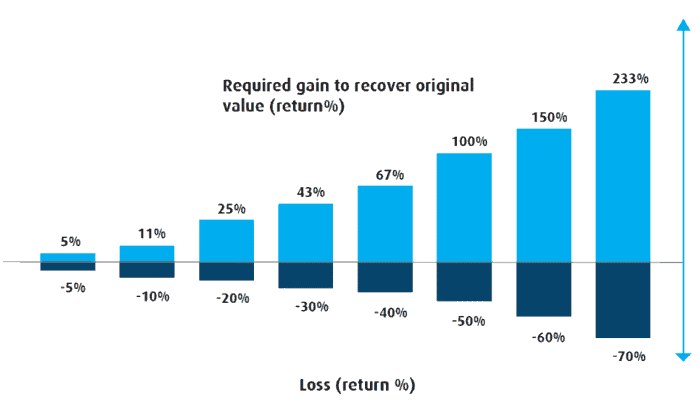

The right amount of risk, aside from it being linked to your appetite for risk, depends on your investment time horizon, and is generally linked to age and life stage. In the case of a younger person aged 20, super can be invested in aggressively if desired, because they have 45 years to ride out the market variation. Aged 35 and accumulating wealth, wanting to borrow as much as possible is another scenario. When the market is doing well that works well, but if the market falls or interest rates rise and you can‘t service the debt you could be forced into selling assets and realising losses. You need to leave room for movement. Not over capitalising is key here, and not borrowing beyond your means to pay back the loan. From the perspective of super, diversification could be a good strategy with some still invested in high-risk funds. When you get to retirement you can move to a capital protection strategy by focusing on the preservation of assets. There is likely to be a blend of investment strategy so that there is some growth happening still, but access to cash when needed to drawdown and some level of stability to access cash if markets have a downturn. Keep in mind there is still another 20 years ahead to fund, so the more solid the strategy the better. We have written many articles on funding retirement. You can browse articles in our Knowledge Centre articles here, in particular, our recent articles ‘The cost of caution when funding your retirement’, ‘How much do you need for a comfortable retirement’, and ‘Ways to invest your money’. Back to the investment philosophy that demonstrates the importance of minimising risk. If you take on too much risk upfront and realise a loss, the bigger the loss, the more is required to recover that loss, and this increases exponentially if those same mistakes are made over time.

Figure 3: Risk and Return

If your Risk is too Aggressive

One type of risk is concentration risk, when your eggs are all in one basket (i.e. one company or sector). If this is the case and losses are being felt, diversification can soft that up. As mentioned earlier in the article, it is better for these decisions to be made objectively, as emotion can come into play and cause behaviour like that seen in the ‘Fear and Greed’ graph (Figure 2). We also come at our investment choices from a personal and family set of experiences. It’s not uncommon for us to meet clients who either have a tendency towards or bias against a particular asset class because that is how their parents invested. Understanding the level of risk inherent in any investment can be difficult, whether you are buying into a direct asset like property, picking shares or a managed fund. Working with an adviser can help you better understand, not only your own preference for investment risk, but also the kind of risk you are currently exposed to and how to best leverage or balance that risk in the long term. Are you ready to talk about your risk appetite? Contact us today about how we can work with you to create an investment portfolio that works for you.

[ninja_form id=37]

If your Risk is too Cautious

If you had $10,000 in cash in 1989 and stashed it under your bed, it would still be $10,000 now. If you factor in inflation or the increase in the cost of living, you will be behind. If we take current interest rates for cash deposits, of 1-2% and look at that return, the amount would grow by $1-2,000 in ten years. That is an improvement, however, it is running at a rate similar to current inflation. Still no great improvement. Take an investment that returns 5% per annum, which is what you could be looking for with a share portfolio, and you’re getting ahead of the game. Moneysmart.gov.au gives an overview of what you may be able to expect with different types of investments here and takes into account the level of risk each holds and what time-frame to consider.

Asset Classes

For this section, we hand over to Adviser Ronald Ngo who gives an overview of Asset Classes and commonly held perceptions by Clients regarding what is the riskiest and what yields the highest returns. “When we talk about Asset Classes, we are typically referring to:

- Cash

- Bonds

- The property, both listed and unlisted

- Shares

- Alternatives – infrastructure, commodities, etc.

“When I ask Clients which is the riskiest and which is the safest, Clients typically say

- Cash is the safest

- Bonds are a bit risky however they are less risky than property

- Property is safe (which is a misconception)

- Shares are the riskiest – most volatile and the highest risk.

“Then when I ask Clients what they think provides the best returns the response is usually:

- Cash is the lowest

- Shares is the highest along with property

- I like property more as the risk is lower than shares

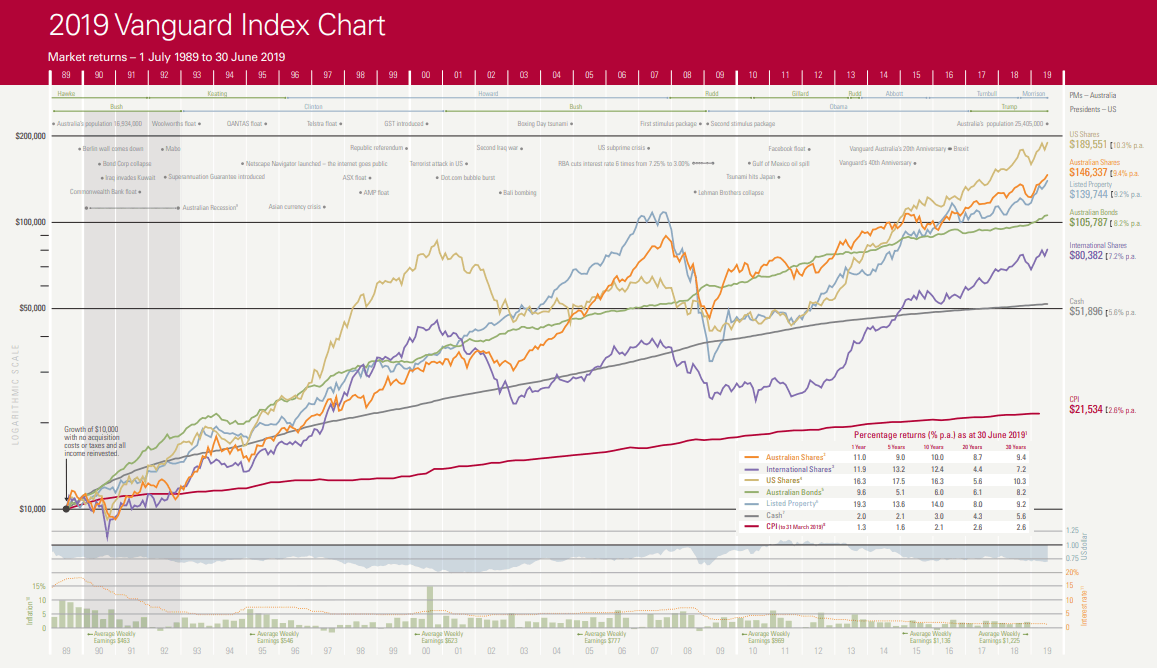

“In reality, shares are probably considered riskier than property however they are both ‘up there’. “Clients often over-estimate the safety of property and pair it with a low perception of risk. You can read our article here on whether it is better to invest in property or shares.” explains Ron. This isn’t to say you shouldn’t invest in property, but only to say that a rigorous investment portfolio will likely have a mix. As stated above, every individual is different, both in their appetite and opportunity for risk-taking, in what they have already and what they want for their future. Revisiting the Vanguard index, you will see that when the market is strong, all share types tend to do well. If we use an analogy when there is a high tide all boats go up, and when there is a low tide all boats go down.

Figure 4: Vanguard Index Chart 1 July 1989 to 30 June 2019

How much risk do you need?

How much risk you need really comes down to how much time you have, and when you need access to your money. There is a lot to consider when determining the best investment strategy to suit you. Humans being humans, these are conversations best shared with someone who can help you articulate your needs and take an outsider’s view of the options you have on the table. An adviser won’t make decisions for you, but we will help you understand your options more fully so you can make an informed choice about your future. If you already have an investment portfolio, fill in our investment report card and see how you are tracking. Don’t get caught out with poor investment choices. Speak with an Adviser about how to make your money work harder for you. Book an appointment or contact us. We’re here to help at Invest Blue!

[ninja_form id=41]

[1]https://www.yourdictionary.com/risk[2]https://en.wikipedia.org/wiki/Law_of_averagesWhat you need to knowThis information is provided by Invest Blue Pty Ltd (ABN 91 100 874 744). The information contained in this article is of general nature only and does not take into account the objectives, financial situation or needs of any particular person. Therefore, before making any decision, you should consider the appropriateness of the advice with regards to those matters and seek personal financial, tax and/or legal advice prior to acting on this information. Read our Financial Services Guide for information about our services, including the fees and other benefits that AMP companies and their representatives may receive in relations to products and services provided to you.

Posted in Investing