How much does a single person need to retire?

November 20th 2020 | Categories: Superannuation & SMSF | Retirement | Financial Planning |

With divorce rates highest amongst those nearing retirement (eg. aged 50+) as reported by the Australian Bureau of Statistics, this is a key reason for why more Australians are entering retirement single.

There are of course many other reasons you may find yourself retiring single such as from separation, a partner passing or simply a preferred lifestyle choice. This could potentially be the first time you’ve been single in decades, if not your entire adult life, and it can create a few setbacks to your overall financial position.

Navigating retirement on your own can be quite overwhelming, especially for those whose partner usually managed their finances.

So, to help you on your journey to living your best possible life in retirement, we firstly discuss how your finances can change when becoming single, as well as provide some tips on how to retire comfortably in Australia.

If you would like to discuss your options and how you might manage it from a financial perspective, please get in touch.

[ninja_form id=37]

Financial changes when retiring single

Living expenses

No matter what your age, there is a big difference in the amount you need to live off for those that are single compared to couples.

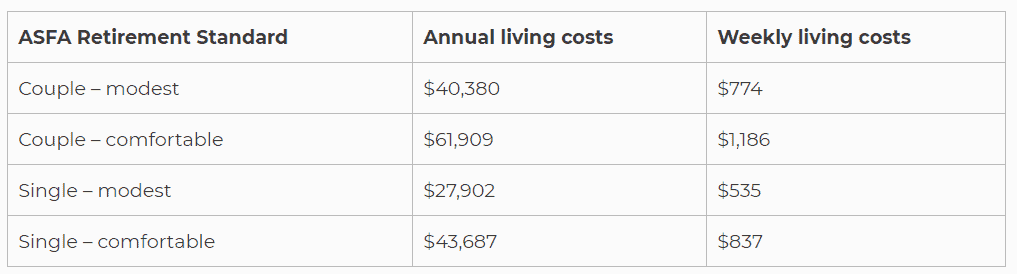

According to the Association of Superannuation Funds of Australia’s (ASFA) Retirement Standard, a single person needs roughly $27,902 per year for a modest lifestyle and $43,687 for a comfortable one.

Whereas, for those retiring as a couple they require $40,380 for a modest lifestyle and $61,909 for a comfortable lifestyle. This is illustrated in the table below.

When you take into consideration weekly living expenses for a single person, it has been found to be roughly 60 per cent more as opposed to a couple. This is due to singles having to bear the cost of such expenses like groceries and household bills on their own, instead of splitting it amongst two incomes.

When these minimum financial requirements are compared to the Age Pension of $21,222 per year for singles, and $31,995 for couples, it is evident you can’t rely entirely on it for your retirement funding. Therefore, even if you are retiring solo or as a couple, it is essential to plan beyond your pension payments to ensure that you can enjoy your golden years comfortably and live your dreams

Superannuation

You may decide to access your super in gradual payments, which can act as a stream of income or access it as a lump sum.

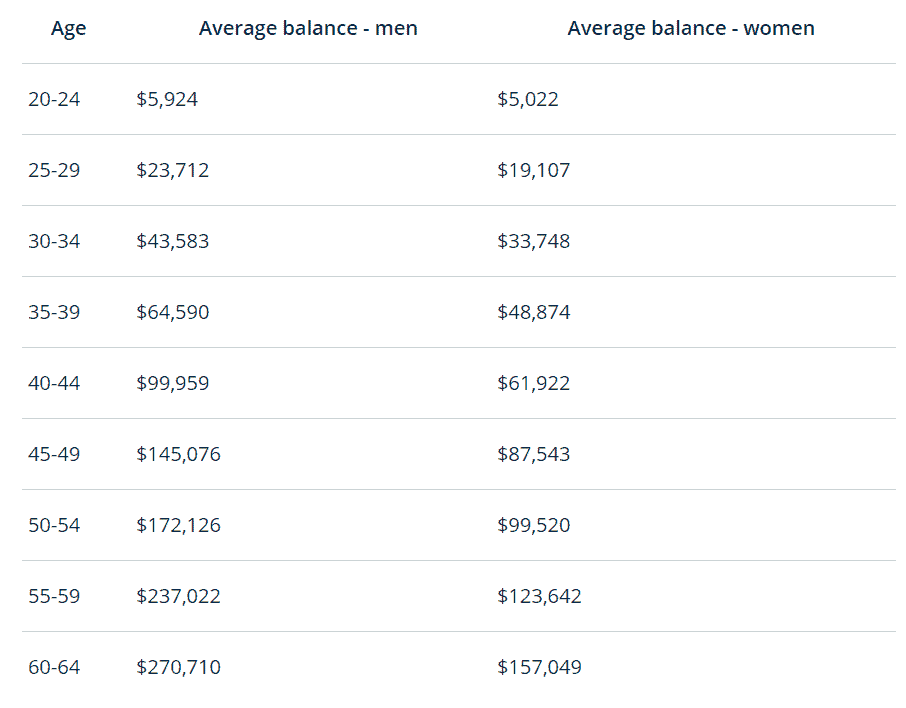

A recent study revealed superannuation balances for females were on average 40 per cent lower than their male counterparts. This means for women entering retirement they may be more reliant upon the pension or savings, which can add to financial stress.

For those divorcing, your superannuation is considered as an asset and therefore may be split during separation. You can read our full article on “divorce and superannuation – splitting retirement savings” to learn more about this.

The table below demonstrates the gender super gap by showing the average balance of super accounts for both males and females. Due to both the pay/super gap, there is a concerning amount of older women facing poverty in Australia. You can read more on that here.

You may also be interested in our article “women, wealth and money decisions”.

Pension

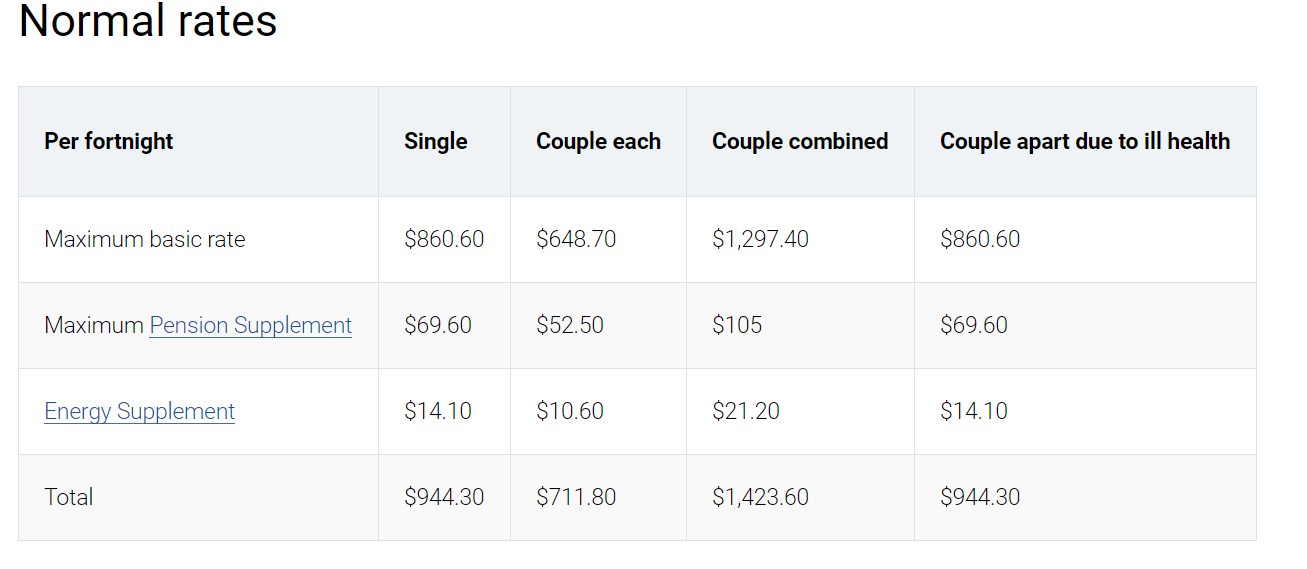

There is good news for singles when it comes to the pension. To compensate for increased living expenses, payments to solo retirees (as highlighted below) are higher compared to those in a couple.

Tax

Depending on what stage of retirement you are in, will determine how you are taxed.

You may find our article “strategies to reduce tax” useful.

Coming back strong after separation

We know it can be both emotionally and financially difficult when it comes to dealing with divorce. So, it’s heartwarming to hear stories of Australians coming out on the other side stronger than ever. One of our clients who faced an unexpected separation at the age of 62 never imagined she would be able to own her own home again.

With the help of Invest Blue Financial Adviser, Luke Warren, the client was able to identify her goals and dreams and had the confidence and security to go after them. Christine had goals to buy and travel Europe, and within 12 months she had achieved both these dreams.

“It’s quite amazing what we have achieved in such a short amount of time, but Luke got straight in, initially making practical efficiencies, such as rearranging my super so I had fewer fees, and then helping me set guidelines and longer-term goals. Luke was extremely positive and sensitive to my situation, it was he who actually encouraged me to take an overseas trip – which was one of my goals, before embarking on the house.”

You can read Christine’s full story here.

Our top comfortable retirement single life tips

Any time you face a significant change in your life or finances it is important to seek the advice of an expert. It’s one of our top tips as not only will they help you navigate nonbiased negotiations, they will also help guide you through these changes so you’re left without the stress, and can give you confidence about your current position.

An adviser will be able to help create a clear plan forward and provide you with structure and security in a solid financial plan, which is crucial to avoid added financial stress.

It is indeed attainable to live a comfortable and happy retirement alone if the future is well planned for it. Firstly, it comes down to the two key areas that need to be answered being “what are your dreams and goals?” and “what does your budget look like?”.

Once you properly explore these two questions you’ll then understand exactly how much you need to achieve your dream retirement, what kind of funding or investment options are available to you and how much you need to have kept aside for a rainy day.

Some options to consider include:

- Downsizing your home

- Consolidating or refinancing debt

- Seeking the advice of a financial adviser

- Reviewing the structure of your superannuation

In addition to mapping out your financial security with the help of an adviser, retiring as a single also calls for strong emotional support. So, our next tip is you should have a healthy circle of friends and identify your most trusted companions to be your emergency contacts and power of attorney.

Also, by maintaining a socially active lifestyle, pursuing hobbies and having a solid support network to enjoy your golden years with are key to helping you live your best possible life in retirement.

All in all, the bottom line of a stress-free retirement is efficient planning. Whether you retire as a single or a couple, it is important to plan and seek the advice of a professional if you find your financial position changes or you need support and confidence to move forward.

Speak to us today to find out how we can help you.

[ninja_form id=41]

What you need to know

This information is provided by Invest Blue Pty Ltd (ABN 91 100 874 744). The information contained in this article is of general nature only and does not take into account the objectives, financial situation or needs of any particular person. Therefore, before making any decision, you should consider the appropriateness of the advice with regards to those matters and seek personal financial, tax and/or legal advice prior to acting on this information. Read our Financial Services Guide for information about our services, including the fees and other benefits that AMP companies and their representatives may receive in relations to products and services provided to you.

Posted in Superannuation & SMSF, Retirement, Financial Planning