Diversifying inside super

March 6th 2016 | Categories: Investing |

What is diversification?

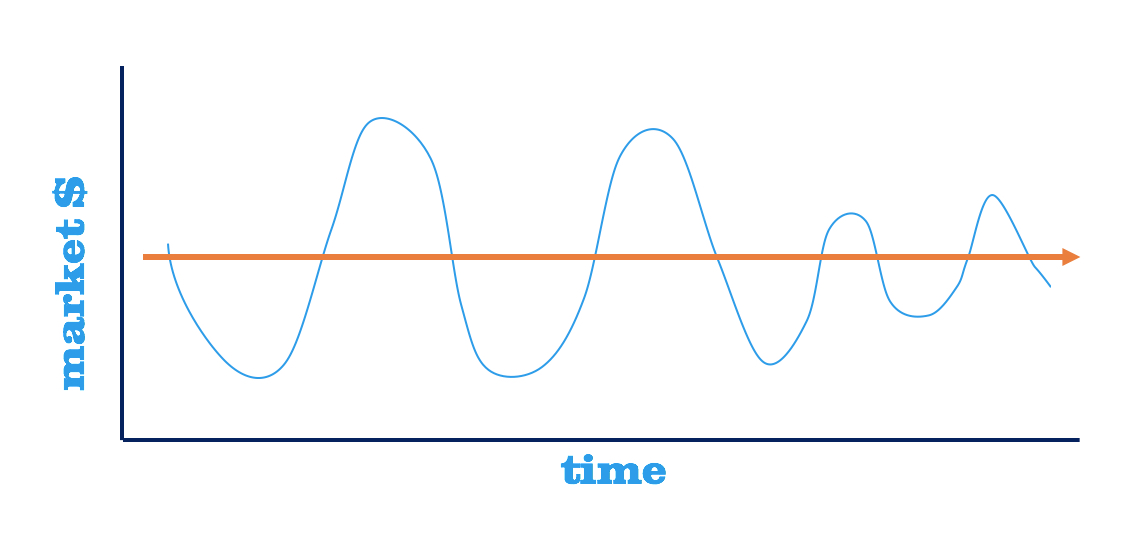

Diversification is a risk strategy that lets you ride the ups and downs of investing. It reduces your exposure to risk, so your investments won’t be as affected by fluctuations in markets.

How do you diversify?

Investment diversification can be achieved by choosing a mix of:

- asset classes (cash, fixed interest, bonds, property and shares)

- industries (e.g. finance, mining, health care), and

- markets (e.g. Australia, Asia, US).

You can also invest at different times to reduce your level of risk through investment strategies, such as dollar cost averaging.

Diversification when it comes to super

Super funds employ investment managers to decide on the best investment approach for members of the super fund. They actively diversify investments within and across different asset classes. The investment manager then buys and sells assets on behalf of super fund members with the aim of delivering the best possible investment returns. Most funds will allow you to choose from a range of superannuation investment options with varying levels of risk and return (such as conservative, balanced or high growth, for example).

Consolidate to diversify

You may think having your super spread across multiple super funds means you’re diversifying. However it also means you’re paying multiple fees and your super savings are harder to keep track of. You might want to consider consolidating your super today so you can:

- save money—one super fund means one set of fees, potentially saving you hundreds of dollars each year and thousands over a lifetime

- save time—having one fund is easier to keep track of with less paperwork and administration

- find money you didn’t know about—you can conduct a lost super search as part of your consolidation

- simplify control of your investments—with one fund it’s easier to manage an investment strategy to meet your needs.

Before you consolidate, it’s a good idea to check if you’ll pay any exit or withdrawal fees from your existing super fund and if you hold any insurance in your existing fund and want to keep it, whether you can transfer this over.

Working out what’s right for you

Everyone’s situation is different. So you need to think about your personal situation, your investment goals and the level of risk you’re prepared to take, to ensure your investment option within your super is right for you.

Not sure what the right investment option is? Get in touch with an adviser can help you work out whether you need to change your investment option based on your life stage or risk tolerance for example.

Keeping track of your super

While your super fund investment managers are managing your super investments for you, it’s still a good idea to keep track of how your investments are performing. If you’re an AMP customer, remember to log into My AMP where you access your super statements, view up-to-date unit prices in your investment portfolio summary, change the way your super is invested and much more.

If you’d like help with working out the right diversification mix for your super, get in touch with us today.

Want a Complimentary Consultation?

Fill in the form for a complimentary consultation with a Financial Adviser and start living your best possible life.

What you need to knowThis information is provided by Invest Blue Pty Ltd. (ABN 91 100 874 744). The information contained in this article is of general nature only and does not take into account the objectives, financial situation or needs of any particular person. Therefore, before making any decision, you should consider the appropriateness of the advice regarding those matters and seek personal financial, tax and/or legal advice before acting on this information. Read our Financial Services Guide for information about our services, including the fees and other benefits that AMP companies and their representatives may receive in relation to products and services provided to you.

Posted in Investing