Addressing current market volatility concerns

June 24th 2022 | Categories: Financial Planning |

We understand the recent dip in share markets has raised concern and worry for many of our clients. In this market update, we address the current market volatility and also discuss your best defence in these challenging times.

Most of this year’s market turmoil has been caused by inflation numbers spiking well beyond the ranges that Governments and Central Banks are comfortable with. Most Central Banks state inflation of 2-3 per cent is their target range – however recent numbers have been pushing into the 7-8% range.

There is no doubt the inflation fires have been fanned by supply restrictions and events beyond market and government control. Things like the supply hangovers from Covid, the Russian invasion of Ukraine and China locking down its population (and businesses) hard in the pursuit of Covid zero. However, there is evidence of demand-side impacts flowing through with increased wage demands spurring further inflationary pressure.

One of the primary inflation-fighting weapons Reserve Banks have is to tighten monetary policy – typically by raising interest rates. They have begun doing so and flagged vastly higher rates than were previously thought only a few months ago.

One thing markets hate is uncertainty and they have reacted predictably to the fast change in policy. In particular, there are concerns that fighting inflation via higher interest rates will suppress economic growth, raising the likelihood of a recession in the next 1-2 yrs.

Most markets have been hit – from fixed interest to listed property and share markets. In fact, US share markets are in “Bear Market” territory – having fallen more than 20% from recent market highs. You can read more about that here.

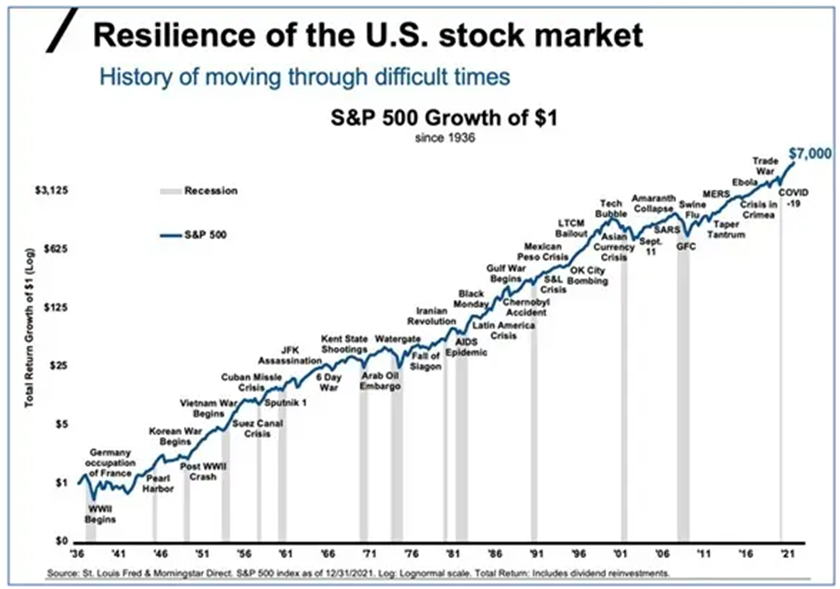

While this may seem alarming this is nothing new for the share market as correctional phases or bear markets occur on average every 4 years. We can reflect on past events and the performance of the stock market to see that long term the market always recovers and trends higher growth.

You can access all our recent market updates here.

While we can’t be sure markets have dropped to their lowest, we can provide guidance on how to manage the current market volatility.

- Our investment philosophy focuses on risk vs return and the importance of long-term investments. Your investment strategy is built to handle market dips and correctional cycles. We expect them – we just don’t always know when they are coming.

- Recognise that we have seen it all before as periodic sharp falls are regular occurrences in share markets. Over the last 50 years, even the worst market pullbacks rewarded investors for staying their course.

- Block out the noise! We expect to see many negative headlines during this time as the Fed tries to cool the economy. It is best to try to block this out as it only causes more harm than good and makes it harder to stick to your long-term investment strategy.

- Take advantage of cheaper markets if you are in a position to do so. When assets fall in value they are cheaper and offer higher long-term return prospects; look for investment opportunities that pullbacks provide.

Whilst the temptation can be there to chop and change your investment approach. History tells us this is often the worst thing to do. Making wholesale changes to your investment strategy gives you two chances to get it wrong. When to get out and when to get in. Hope is not a strategy – hoping you get this right is akin to gambling. The best defence is to have a robust strategy and stick to it.

If you would like to have one of our Advisers review your investment strategies or discuss your investment plan and options, fill out the form below and we can arrange a complimentary initial consultation to see if we can help.

Want a Complimentary Consultation?

Fill in the form for a complimentary consultation with a Financial Adviser and start living your best possible life.

What you need to know: This information is provided by Invest Blue Pty Ltd (ABN 91 100 874 744). The information contained in this article is of general nature only and does not take into account the objectives, financial situation or needs of any particular person. Therefore, before making any decision, you should consider the appropriateness of the advice with regards to those matters and seek personal financial, tax and/or legal advice prior to acting on this information. Read our Financial Services Guide for information about our services, including the fees and other benefits that AMP companies and their representatives may receive in relation to products and services provided to you.

Posted in Financial Planning