Just what the doctor ordered

July 25th 2019

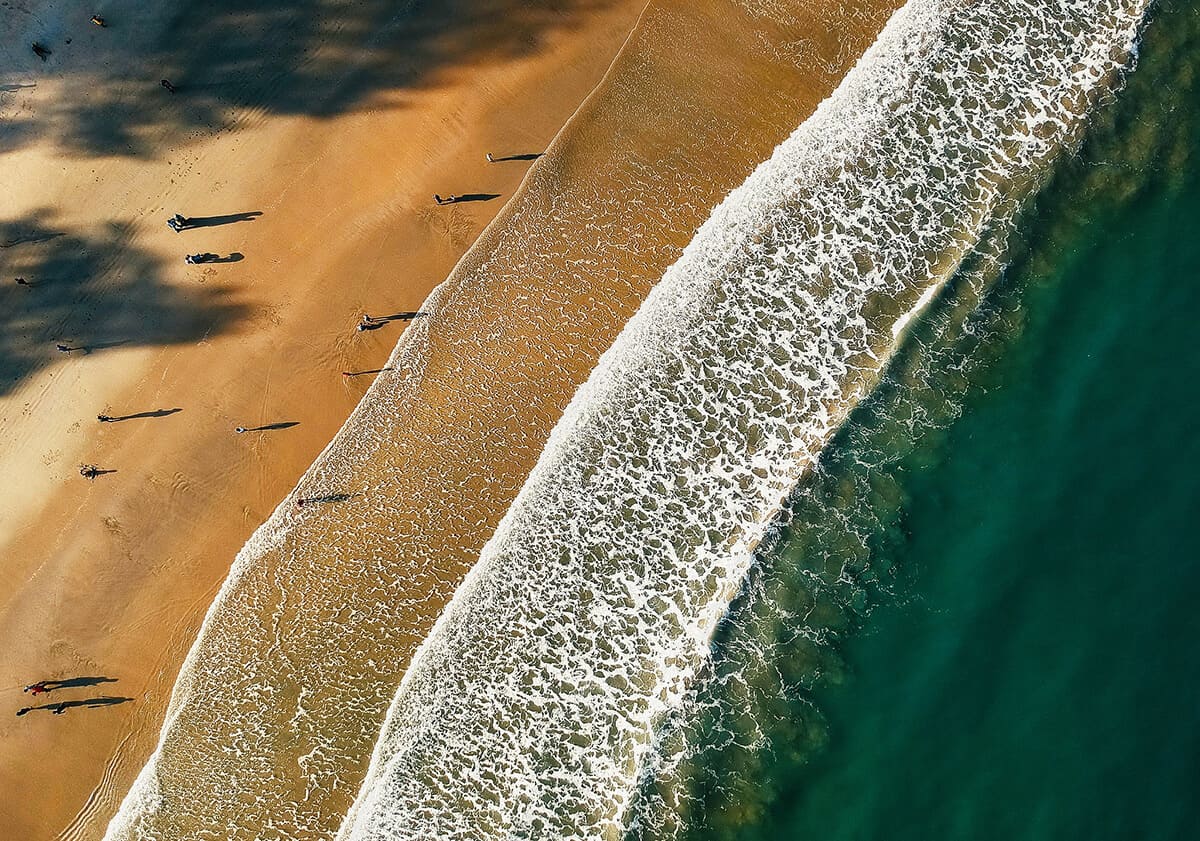

How financial advice supported this Doctor’s immigration from the UK to Australia and ensured her financial future is as bright as our big skies and sparkling beaches.

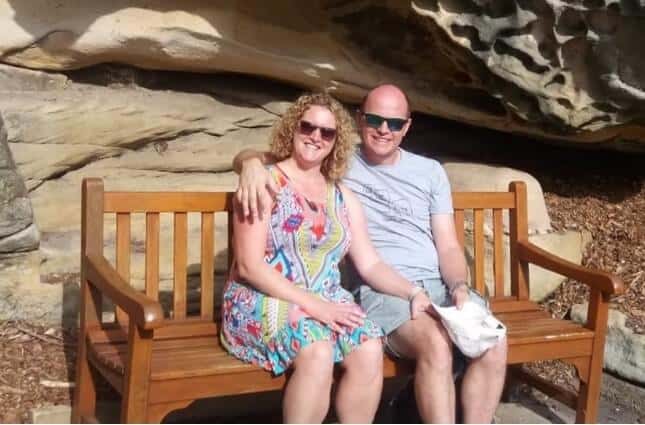

GP Dr Nicola Newman may have excelled through the rigorous academic requirements of medical school, but mention investment strategies or superannuation, and she’s left stumped. For Nicola, give her “care of the physical health of others” and it’s a “tick” – Nicola’s acute decision-making skills instantly kick in. Give her “financial health” however, and it’s a “cross” – something even she finds extremely complicated. Fortunately for Nicola and husband Ken Gough, Invest Blue’s Theo Holland was on hand to assist. He has their finances well managed, and is, as she describes, an extremely patient adviser. Nicola and Ken moved across from the UK five years ago, attracted to Australia’s lifestyle and weather. The Gough’s, both 40, engaged Theo upon their arrival – and it seems not a moment too soon.

“In the UK the tax system is quite straight forward, it’s very black and white – over here it seems very involved, there are so many loopholes and as a GP I’m considered a sole trader – it was very hard for us to get our heads around it all.”

Nicola and Ken left behind an investment property as well as private and government pensions. Theo, Nicola says, was imperative in helping navigate their financial transition between the UK and Australia.

“I’m always stopping Theo mid-sentence asking him what exactly is capital gains tax or some other seemingly straightforward question – Ken rolls his eyes, but Theo is so obliging,” she laughs. “He also helped guide us practically upon arrival in our new country, helping us source an accountant and constantly finding the most tax-effective strategy for our savings.”

Superannuation, a word that would baffle anyone, was another foreign concept to the couple. Theo comprehensively explained the importance of “Super”, and helped organise and transfer Nicola and Ken’s UK based pensions. Nicola will also have access to her UK-based NHS Pension when she’s 65. Theo also went a step further and organised all of Nicola and Ken’s life insurance so they know they have security should they need it. According to Nicola, Theo’s greatest contribution to the Gough’s, however, may have been the streamlining and budgeting of their income. For a number of years, the couple has been trying to start a family, and are now looking into the adoption process. As such, Nicola and Ken’s financial future could change at any moment.

“Theo is so understanding and sensitive to the fact that our main goal is having children, and that should this occur our income and circumstances could change very quickly. He has our finances and budgets prepared for any sudden changes, and is as invested in our future as we are.”

For now, Theo has helped the Gough’s set up a home and strong financial future. The Gough’s rented for the first few years here, until they gained their permanent residency. Their residency in fact coincided with the passing of Nicola’s father, so the couple received a small inheritance which allowed them to purchase their own home here in Australia. While Theo was setting the couple’s mortgage wheels in motion with the bank, the Gough’s kept him on his toes by deciding to purchase the first home they looked at.

“It ticked all the boxes and it was certainly a surprise to find a house so quickly. Theo had to work fast and hasten our mortgage process, but nothing was ever a problem.”

Two years ago Nicola and Ken also sold their investment property in the UK. Theo was able to expertly funnel those funds into platforms that will make the Gough’s money work for them. Some of that money went into super and the Gough’s mortgage is structured so that some went into that.

And while the Gough’s are not making any significant financial goals beyond completing their family, they have treated themselves to a number of little luxuries.

“My husband just loves cars, he turns them over every two years and it’s his thing. It’s always reassuring that Invest Blue never questions or judges this spending, the value of lifestyle is realised and encouraged and Theo respects what we choose to prioritise.”

Having moved all the way from the UK to take advantage of the Australian weather, Nicola laughs that a backyard pool was also a must.

“Theo expanded our mortgage to facilitate a pool, which has been bliss – to come all this way and not have a pool would be quite silly!”

Whatever the future may bring for the Gough’s, Nicola is confident that thanks to Invest Blue they have a good strong financial path ahead.

“Theo has virtually held our hand through every financial decision and process upon moving to Australia and has provided huge relief during times that can easily become overwhelming.”

The fact that Theo’s path is so similar to the Goughs – he also moved from the UK and is married to a GP – was reassuring. It has been nice for the Gough’s to have received advice they can trust from someone who knows first-hand what they have been through and are experiencing, especially when moving to a whole new country.

Start your journey to your best possible life! Get in touch.

Want a Complimentary Consultation?

Fill in the form for a complimentary consultation with a Financial Adviser and start living your best possible life.

What you need to know: This information is provided by Invest Blue Pty Ltd (ABN 91 100 874 744). The information contained in this article is of general nature only and does not take into account the objectives, financial situation or needs of any particular person. Therefore, before making any decision, you should consider the appropriateness of the advice with regards to those matters and seek personal financial, tax and/or legal advice prior to acting on this information. Read our Financial Services Guide for information about our services, including the fees and other benefits that AMP companies and their representatives may receive in relation to products and services provided to you.These clients have agreed to share their stories. Everyone’s situation is different, so their choices and outcomes will be different to yours. Consider your circumstances before deciding what’s right for you.