A life’s hard work rewarded

September 10th 2019

The decision to sell a family farm is never an easy one, but for retired Biloela grazier Noel Kelly, once the resolve was made there was no stopping him embracing his next chapter. In fact, literally, even the paperwork necessary for the sale of his property couldn’t detract him from hitting the road on his caravanning retirement dream.

For Noel, the process between making the decision to sell, and actually selling the property took three years. In anticipation of his lump sum, and encouraged by his daughter Rachel, who is an accountant at Invest Blue, Noel engaged Invest Blue financial adviser, Marc McMahon, to manage his financial windfall efficiently and effectively only a few months prior to the sale. By the time the sale was complete, Noel was so keen for his adventure that he was already on the road. Noel laughs that while Marc encouraged him to stay in the area to sign contracts and finalise the paperwork, his recommendations fell on deaf ears.

“I sold my property to go travelling, and once it was sold, I wasn’t hanging around – we were geared up and ready to go!”

Together, Marc and Noel found solutions to ensure paperwork was received and delivered in a timely manner so that Noel could set off on his caravanning adventure with full confidence. From Northern Queensland’s Karumba to Burketown, Noel accessed local libraries across the top-end’s remote tourist trail to print and sign emailed documents and sent the hard copies back to Marc. Admitting he’s not very ‘tech-savvy’, Noel concedes he was slightly concerned how successful the process of signing documents remotely would work, but was grateful to be guided every step of the way over the phone by Marc. The finalisation of the sale is a testament to modern technology and Invest Blue’s solution-based, client-led culture. The ability of Marc to respond so readily to what may have been a challenging scenario was also hugely appreciated by Noel. Noel, who is travelling with his partner, plans to be on the road for three years – potentially more if he so desires – and thanks to Marc, now has the peace of mind that his finances have been smartly managed and invested to fund his trip, plus retirement. Existing debts were settled, and Noel now receives an account-based pension that is able to be accessed tax-free due to his age.

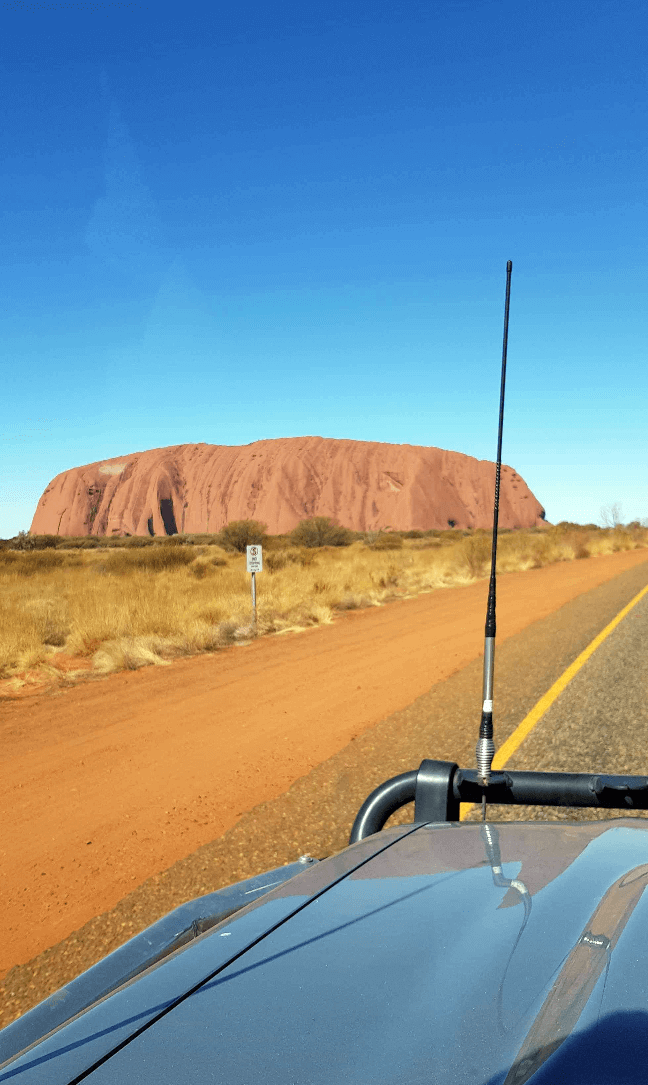

When Noel first started grazing cattle he was on a wage, but once he went out on his own it was hard to know where the next paycheque would come from, such as the nature of agriculture. He laughs that now, thanks to Marc, he feels like he’s back on a wage again – but this time someone is paying him to travel! Chatting of his adventures from his current stop at Northern Territory’s Barkly Homestead, Noel has not looked back since making the decision to sell his property and retire. In his late 50s, he did not want to leave the opportunity to travel too late, which is unfortunately what happened to his parents. With grazing cattle relentless work – seven days a week, 365 days of the year – he was ready to embrace a change in lifestyle but nervous about slowing down completely. Now a few months into their trip, with the sale complete and their finances sorted, Noel hasn’t looked back. He’s settled into a steady routine, travelling from Biloela up through Northern Queensland and now Northern Territory, deciding the route and then stopping for a couple of days.

Stunning gorges and pristine beaches have punctuated his trip so far, but the people he’s been meeting along the track have been a highlight. And having never travelled much before, visiting each region is a thrill.

“In every region we have found hidden gems, the fact is there’s just no way of realizing what amazing scenery and communities are off the beaten track until you take a look yourself.”

Next on the agenda is Western Australia, which Noel has been told will win hands down in regards to scenery. From there the couple will meander through South Australia and wind back up Eastern Australia. Recently Noel decided to do an impromptu trip to Mt Isa for the annual rodeo’s 60th anniversary. As he too turns 60 this year, he felt it was a good sign and was not disappointed. Free camping for four nights, fishing, relaxing and then the rodeo to top it off – it’s the epitome of freedom and the trip is meeting his expectations in every regard.

A budget, set by Marc, also fulfils all his needs. Marc was able to come up with a weekly allowance beyond what Noel expected, yet despite this, he is still spending cautiously.

At the start of the trip, Noel admits to ‘wanting to see and try everything’ but now he’s settled into a routine he’s not spending as much. Meals are generally home-cooked along the way, with the odd meal out, and Noel is careful not to deny himself of experiences – ‘we’re not living like hermits’ – he laughs.

And it hardly seems so, considering his most recent meeting with Marc was actually conducted over the phone from Katherine, where he had just been up on a helicopter tour visiting local gorges. It’s a far cry from mustering cattle in Biloela, but Noel has kept one other farming block in the Monto district, which his son now manages, in case he gets tired of the slow life. But for now, with the assurance that he can afford the retirement of his dreams, and a taste for the open road, a move back to farming does not look imminent.

“To start off I missed the lifestyle, but now sitting still is the hardest thing I have to do – just watching the sunsets, the birds flying past and discovering every corner of Australia – it doesn’t get much better than this.”

Financial Planning can help you to live your best possible life now and in retirement. Contact us.

[ninja_form id=41]

What you need to know

This information is provided by Invest Blue Pty Ltd (ABN 91 100 874 744). The information contained in this article is of general nature only and does not take into account the objectives, financial situation or needs of any particular person. Therefore, before making any decision, you should consider the appropriateness of the advice with regards to those matters and seek personal financial, tax and/or legal advice prior to acting on this information. Read our Financial Services Guide for information about our services, including the fees and other benefits that AMP companies and their representatives may receive in relations to products and services provided to you.

These clients have agreed to share their story. Everyone’s situation is different, so their choices and outcomes will be different to yours. Consider your circumstances before deciding what’s right for you.