Australians seeking advice – what are the trends?

May 26th 2020 | Categories: Value of advice |

As much as the current turbulent times have closed many doors, it is safe to say that they have opened many, too! On one hand, we have become more sensible and sensitive to the environment, sustainability, and expenses. On the other hand, we have increased our spending on advice and education to weather the storm. Trending areas of sought-after advice include advice for our physical, mental, and financial wellbeing.

Advice, in its entirety, has become highly valued in the present times. Australians are shifting their focus toward health and wellness and have increased their spending on personal trainers, life coaches, naturopaths, body-mind fitness experts, fitness instructors, and so on.

Overall, the general living expenses of the average Australian has grown rapidly in recent years, with health and wellness being the fastest growing industry. Australians are spending considerable time and money on yoga, aerobics, infra-red sauna, complementary health, oxygen therapy and other fitness trends.

The drive behind increased spending on fitness and physical advice is to improve general health and wellbeing and to reduce stress. According to the Australian Bureau of Statistics, Australians are feeling more stress than ever before and advice is working as an antidote. With finances being the largest cause of stress for Australians, many are now seeing the value in financial advice and the role it can play in reducing financial and overall stress.

Understand how a financial adviser can support you with your need for financial security. Get in touch.

[ninja_form id=37]

Demand and Scope for Financial Advice

The Australian financial planning sector has been one of the fastest-growing industries in the past couple of decades. It is worth AUD 4.6 billion in terms of revenue, with over AUD 4 trillion in funds under management and more than 25,000 financial planners in Australia.

The financial planning industry forms the foundation of financially secure life for many Australians and can support you in making confident financial decisions. Statistically, around 2.6 million Australians took on financial advice in 2016-2017 and today, one out of every five working Australians seeks financial advice.

Despite the growing knowledge on the importance of financial advice, more than 48% of Australians claim that their financial planning needs have not been tended to. On a positive note, 41% of Australians plan to see a financial adviser in the near future and although a portion of this percentage will still resist advice for various reason, it still indicates a large opportunity for growth in the sector. You can read more about why we resist financial advice here.

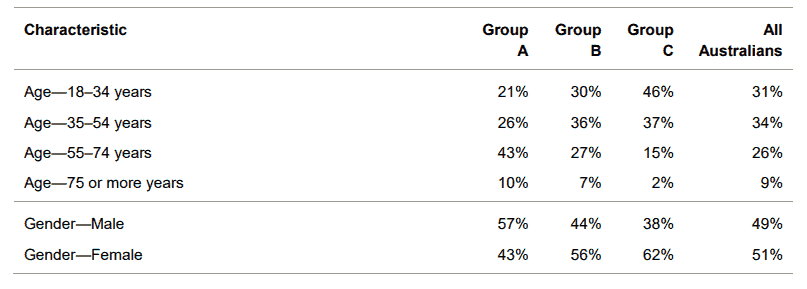

The Australian population is also ageing, the population projections suggest that by 2022, Australia will have more than 4 million people between the age of 65 and 84, and the people above the age of 65 will form 23% of the population by 2050. Below you can see clients approaching retirement age make up the largest demographic of advice clients, as a result, it is expected with an ageing population there will be a rise in the need for advice, creating more demand for financial advisers.

You may be interested in our article “How Do You Even Start Planning for Retirement”

Table 1: Profile of those who have sought and who have considered seeking financial advice.

How the Trends Towards Investing in Advice Can Benefit Financial Planning Industry

We can see the trends are moving towards advice and there is massive scope for financial planning. However, the challenge lies in using the trends towards advice to make people think about seeking financial advice for their own financial needs. The focus needs to be shifted towards making financial advice more valued by Australians as a whole.

You may believe financial advice is product-based however there is far more depth in planning that you may think. The trick is to transition the industry from being seen as product-based to service-based. The same way wellness coaches cater to physical wellbeing, financial advisers need to be seen as financial wellbeing coaches. They are rightfully so as they ensure our financial wellness, make us feel calm and confident about our present and future financial position.

Those who see a financial planner are reported to have more confidence around their finances and feel less stressed about money.

Financial security tops the list as Australia’s number one life goal, combined with the demand for stress management the financial industry has the opportunity to convert this demand into a tangible form and bring the consumers and financial planners together. It is essential to display the entire depth and value of financial advice to individuals for them to understand the significance of financial advice.

The trends towards investing in advice should be seen to challenge people to consider financial advice in addition to wellness advice to make the financial planning sector grow further. The challenges, like lack of awareness, affordability, access, regulations, and trust, need to be addressed for Australians to see the real value of financial advice.

You may be interested in our article “Why Australians Seek Advice”.

Bottom Line

As a bottom line, statistics have proved that Australians have become more inclined towards investing in advice. They see the value in physical wellness and wellbeing advice and spend a considerable amount of money and time on it.

The financial advice sector is also prospering; however, not at the same rate. People do not yet equate financial planning and advice with their mental wellbeing. They simply consider financial planning advice as to the profession of selling financial products, superannuation, loans, and other services.

The increasing trend towards investing in advice opens up a huge opportunity for the financial planning industry as well. The only possible means to tap the trends towards investing in advice for the growth of the financial planning industry is making the benefits more visible and tangible.

It comes down to seeing the value of financial planning, how it functions to keep you calm and in control of your financial decisions. A financial adviser can help you in reducing stress levels by pathing a path to create financial security and make your goals a reality.

Are you ready to join those who have sought advice to maximise their financial situation, reduce stress and focus on their dreams and goals for the future? It’s never too early or too late to live your best possible life, no matter what your situation is. Contact us or ask us a question. We’re here to help at Invest Blue!

[ninja_form id=41]

What you need to know

This information is provided by Invest Blue Pty Ltd (ABN 91 100 874 744). The information contained in this article is of general nature only and does not take into account the objectives, financial situation or needs of any particular person. Therefore, before making any decision, you should consider the appropriateness of the advice with regards to those matters and seek personal financial, tax and/or legal advice prior to acting on this information. Read our Financial Services Guide for information about our services, including the fees and other benefits that AMP companies and their representatives may receive in relations to products and services provided to you.

Posted in Value of advice