A beginners’ guide: how to choose and tailor your super fund!

July 21st 2021 | Categories: Superannuation & SMSF |

For most people, superannuation (super) begins when you start work, and your employer pays money into a super account for you. The minimum employers are required to pay – the ‘super guarantee’ (SG) – currently sits at 10 per cent of your ordinary time earnings and will gradually rise over the years (i).

Moreover, you can choose to contribute additional funds to your super through salary sacrifice and personal contributions. Your super fund invests the money, and it is locked away until you retire from work after age 60. There are acceptable reasons for accessing your super before this time, such as compassionate grounds or purchasing your first home (under the FHSS).

Of course, this can be an incredible lifeline in a time of need. However, this decision should not be taken lightly as taking money out of your super will affect your super balance and may affect your retirement income. Speak with a professional to understand what it would mean for you.

How much might you need in retirement? Find out with our Retirement Needs Calculator.

Q. How does a super fund work?

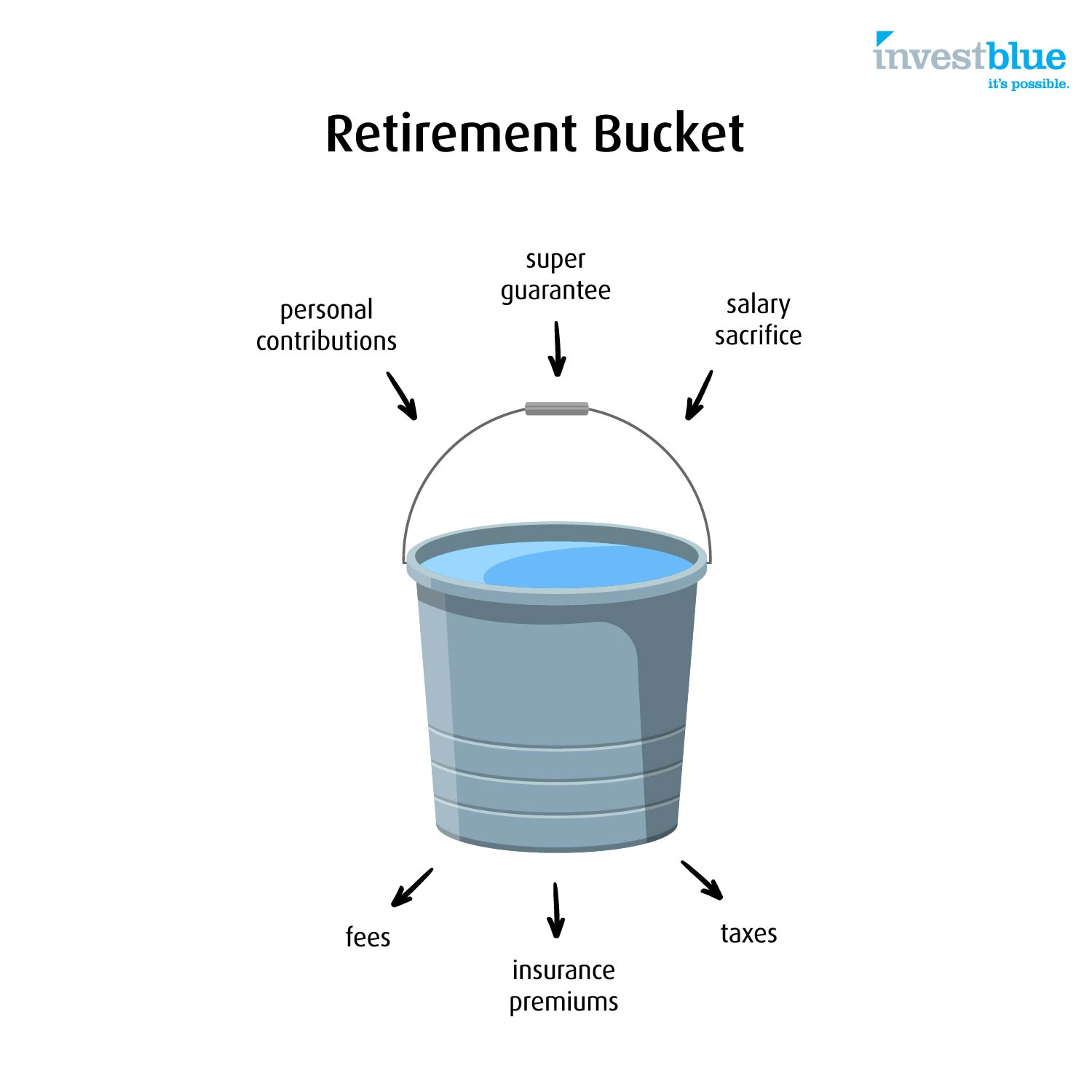

Super is simply a way of saving money while you are working. As shown below, funds (your money) pour into your retirement bucket through pre-tax and after-tax contributions, and small amounts leak out through fees, taxes and insurance premiums (again, your money). The bucket is locked away until you retire on or after age 60, at which point you can access your super fund pension or lump sum without paying tax. The trick is to maximise the funds in your bucket through consistent contributions (legally required while working, check!) and tailoring your fund to your circumstances through investment choice and insurance levels.

Below, we take a deep dive into the latter. That is, choosing and tailoring your super fund. But if you are planning on taking a career break, or you’re currently on one, you could be missing out on regular income and regular super contributions. While there are often many money matters to balance while on a career break, it might be a good idea to put some plans in place to ensure your super keeps working for you while you are off work. Moreover, you could look at ways to grow your super later in life.

Not sure if your super fund is right for you? Get in touch.

[ninja_form id=37]

Q. How to choose a super fund?

Most people can choose a super fund to have their employer make contributions and additional personal contributions. If you don’t select a fund, your employer will pay into a default MySuper account. Therefore, you may have a super account even if you don’t know about it or indeed multiple accounts.

Many employers offer great incentives within their company fund, such as lower fees and insurance premiums and insurance granted without medical history requirements. However, your employer is under no obligation to choose a fund that’s in your best interest (ii). Therefore, you must decide whether their default system is appropriate for you.

Have a look at what your new employer has to offer and compare. Don’t get lazy!

Moreover, default systems often lead to people having multiple accounts. This commonly happens when you change jobs. Every time you open a new super account and start making contributions, any retirement savings in your old account may be eroded by unnecessary fees and insurance premiums (ii). However, this is not always the case.

Depending on your circumstances, holding two accounts may lead to better benefits. For example, your old account may offer mega-cheap insurances, while your new fund may offer better investment options. Rather than losing important cover, you may choose to keep both.

Consider what you’re trying to build into your super. You can tailor your fund to suit your circumstances, such as your investment strategy or levels of insurance.

When choosing a super fund, you should investigate:

- Fees: Be sure to understand what you’ll pay for out of your super in fees, such as administration and investment charges. Remember to check if your current fund enforces an exit fee.

- Performance: Look for long-term performance. Consider a fund that’s done well over the last five years, not just last year’s performance. But remember, past performance is no guarantee of future performance.

- Investment options: You can choose your own risk profile or investment options. If you don’t make a choice, the default will apply. Look at the asset allocation, which drives returns and be prepared for short-term volatility if you have high exposure to shares.

- Insurance: Most super funds offer life insurance, total and permanent disability cover and income protection. So, if you have a super account, you probably have basic insurance cover for any worst-case scenario. You can choose the level of cover that suits your needs by increasing, reducing or opting out.

Check out our Calculators and Tools to help in your investigations.

Our Wealth Management eBook can help you understand the trade-off between risk and return. A must-read!

Things to consider:

- Nominate beneficiaries for your super: This is an important one! Super is the second-largest asset for most Australians, after their family home. To give you the certainty that your superannuation benefits will go to the right people when you die, you can put a binding nomination in place.

- Bring all your super accounts together: Save on fees by consolidating your super funds. But don’t rush into this one! Before bringing all your super accounts together, there are a few things you need to consider, such as:

- Whether you’ll pay any exit or withdrawal fees from your other super funds

- Check the features and benefits you currently have in your other super funds to make sure you’re not losing anything that’s important to you

- If you have insurance cover attached to your other super funds, the insurance will be cancelled if you consolidate into your preferred account. You need to carefully consider whether you have adequate cover for your needs without it

- Seek professional advice: Speaking with an adviser can help you make better choices about where your super is invested and how to make it grow. Keeping your circumstance and current legislation front of mind, an adviser can help you:

- Find any lost super you might have

- Consolidate your super funds and help you save on fees

- Identify investment options tailored to your risk profile and needs

- Review your contributions to super

- Enjoy the benefits of salary sacrifice and other super strategies

- Understand your insurance options within superannuation

- Determine if you have the correct beneficiary nominations for your super assets

- Maximise your super for retirement

- Determine whether a self-managed super fund is right for you

- Identify the benefits for you and your employees of different corporate super funds

David French

Certified Financial Planner®

Connect with David on LinkedIn

Speak with David or one of our trusted Advisers today on how we can help you live your dream life in retirement.

[ninja_form id=41]

What you need to know

This information is provided by Invest Blue Pty Ltd (ABN 91 100 874 744). The information contained in this article is of general nature only and does not take into account the objectives, financial situation or needs of any particular person. Therefore, before making any decision, you should consider the appropriateness of the advice with regards to those matters and seek personal financial, tax and/or legal advice prior to acting on this information. Read our Financial Services Guide for information about our services, including the fees and other benefits that AMP companies and their representatives may receive in relations to products and services provided to you.

Reference List:

(i)https://www.ato.gov.au/rates/key-superannuation-rates-and-thresholds/?page=22#Super_guarantee_percentage

(ii)https://www.choice.com.au/money/financial-planning-and-investing/superannuation/articles/australians-still-being-defaulted-into-poor-mysuper-products

Posted in Superannuation & SMSF