3 tips for a financially and physically healthy life

November 15th 2017 | Categories: Financial Planning |

Do you feel that money is a barrier to achieving a healthy lifestyle? Or maybe that your health is affecting how much you can save?

Either way, it is possible to achieve your healthy lifestyle goals and your financial dreams as well.

But avocados are so expensive, right? Don’t let the excuses get the better of you! Here’s how boosting the wellbeing of your finances can lead to a healthier lifestyle, and how a healthier lifestyle can help you to achieve your financial dreams.

Work with a financial adviser today to achieve your dreams.

[ninja_form id=37]

1) Change your money habits to train your brain

A great way to identify unhealthy habits within yourself is to draw up a budget. Start by making records of how you’re spending and saving your money. It’s important that you acknowledge every transaction – even those sneaky treats.

Many of us are well aware of how much we get paid each cycle, but fail to notice how small payments can build up.

Often, you’ll find those small payments are for things that you don’t truly need. We’re not saying you can’t treat yourself once in a while, but with a budget in place, you’ll likely come to realise that the price of a packet of cigarettes can be better saved for achieving financial goals.

Small changes in the way you handle your money can help reduce spending on unhealthy habits. Carrying cash for your day to day transactions over-relying on contactless payment may help you limit your spending. The median value of cash payments is as low as AU$12. When you choose to pay cash, you can avoid switching to auto-pilot and ask yourself “do I really need this?”

2) Eat better to save more

By taking control of your diet you can not only get your body in better shape, but your finances will be looking fitter than ever. Households in all socio-economic areas of Australia are spending far too much on unhealthy food and drinks – up to 58 percent of their food budget. This comes from the Australian Prevention Partnership Centre (APPC), who also claim that following a healthy diet is actually 12-15 percent cheaper than an unhealthy one.

Furthermore, APPC attributes poor diets as the leading cause of preventable disease in Australia, such as obesity and diabetes. Improving your diet can help to protect you from potential health complications down the line, ultimately saving you money on medical expenses.

3) Find freedom from financial stress

Financial stress can be caused by a number of factors in life – from unexpected unemployment to the development of addictions. Unfortunately, a massive 41 per cent of Australians aged 35-54 years old feel that dealing with money is both stressful and overwhelming, reports ASIC.

If you’re questioning how healthy your financial situation is, you may find yourself arguing with loved ones or obsessing over your finances. Government service HealthDirect suggests that allowing financial stress to continue may lead to the development of mental health issues, such as anxiety or depression.

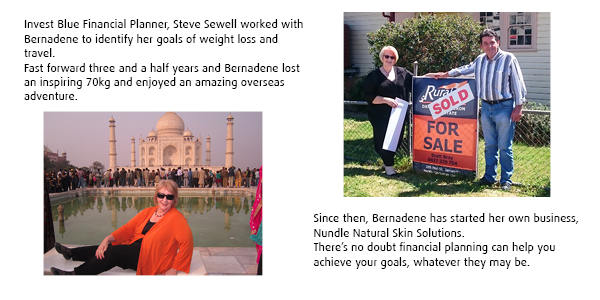

At Invest Blue, our financial advisers will listen to your fears and stress points to develop a comprehensive financial plan for the future. Our interest is in helping you find the stability to live a healthy, happy life from your youth through retirement.

With the right financial advice, you can live your best possible life. Get in touch today.

[ninja_form id=41]

What you need to know

This information is provided by Invest Blue Pty Ltd (ABN 91 100 874 744). The information contained in this article is of general nature only and does not take into account the objectives, financial situation or needs of any particular person. Therefore, before making any decision, you should consider the appropriateness of the advice with regards to those matters and seek personal financial, tax and/or legal advice prior to acting on this information. Read our Financial Services Guide for information about our services, including the fees and other benefits that AMP companies and their representatives may receive in relations to products and services provided to you.

Posted in Financial Planning